The Grocery Effect – How Grocery Store Openings Are Impacting Nearby Retailers

Back in July we talked about how new grocery stores impact residential home values and multi-family rents. See the post here if you missed it.

Today I would like to share with you some findings from Unacast who studied five grocery store locations from our Planned Grocery database that opened in October of last year.

Founded by Thomas Walle and Kjartan Slette, Unacast collects and analyzes human mobility data so organizations can better understand how people are interacting in the real world and see what changes are taking place.

Unacast analyzed human mobility data for the 12 month period from February 2019 to January 2020 and looked for signal changes around the opening date of each grocery store.

Below are some of the results from that study.

To get the full study contact us here with the message “Unacast” and we will send it to you.

1. KROGER, 725 PONCE DE LEON AVE NE, ATLANTA, GA 30306

(Open Date 10.16.2019 // 60,000 Square Feet)

Publix & Whole Foods experienced a small drop in shoppers during Kroger’s grand opening period. Shops at nearby Ponce City Market saw very little change, most likely due to a more regional customer base.

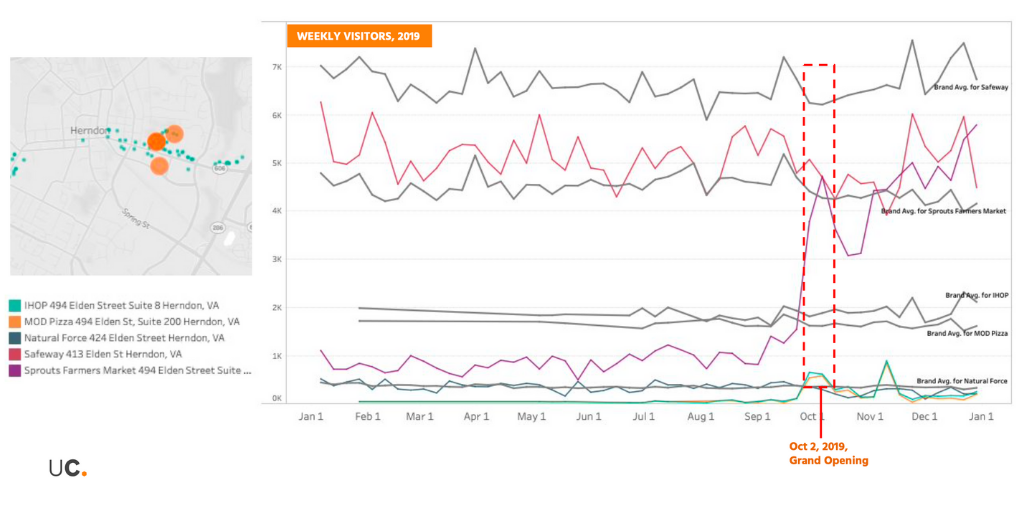

2. SPROUTS, 494 ELDEN ST, STE 11O, HERNDON, VA 20170

(Open Date 10.02.2019 // 30,919 Square Feet)

Safeway & Natural Force both experienced drops in weekly foot traffic in weeks following Sprouts’ new store opening. Nearby IHOP and MOD Pizza saw bumps in foot traffic during and after the grand opening period.

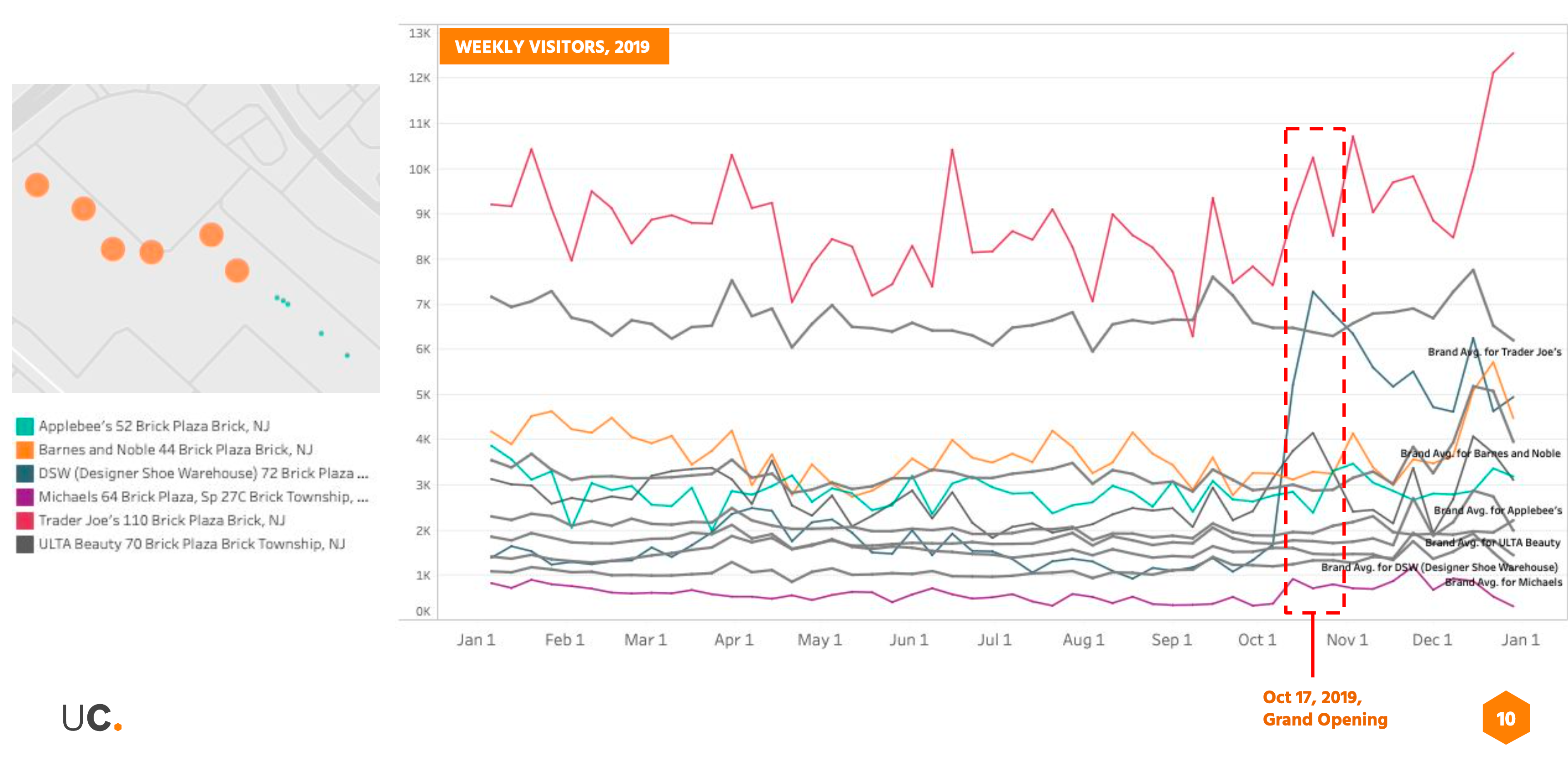

3. TRADER JOE’S, 110 BRICK PLAZA, BRICK TOWNSHIP, NJ 08723

(Open Date 10.17.2019 // 12,500 Square Feet)

Applebees, DSW, Barnes & Noble, Michael’s and Ulta all experienced a rise in foot traffic following Trader Joe’s grand opening.

While this study was done pre-covid, the findings still illustrate how we can use location data to better understand the world around us.

2020 was a year that highlighted the importance of a nearby grocery store to every community. Food deserts and trade areas lacking diverse grocery options were magnified by the pandemic. Over the last year we have seen an increase in grocery activity:

- West coast based Grocery Outlet is rapidly expanding with plans to go nationwide

- Aldi has 33 locations under construction and have opened 68 new stores in the past six months.

- Amazon’s brick and mortar grocery concept is expanding with 19 stores under construction, six recently opened and 10 planned or proposed.

- Earth Fare has reorganized and is reopening many previous locations.

- German supermarket chain Lidl continues their east coast expansion with 33 stores currently under construction.

- Independent grocery stores are expanding and as active as ever

The next few years are projected to be active in grocery development.

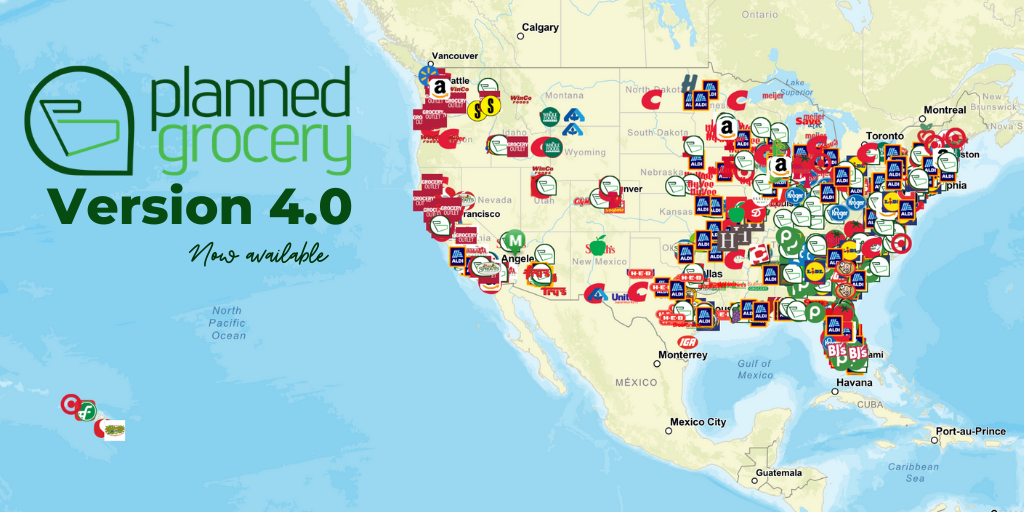

In the last six months alone there have been 336 new grocery stores opened across the US. Planned Grocery is here to help you stay up-to-date with the latest information, providing regularly updated location data with notes detailing the most recent activity. As of today we are tracking 308 proposed, 435 planned, and 396 currently under construction grocery sites.

Learn more about Planned Grocery and schedule a demo at plannedgrocery.com