Private Equity-Backed QSR Groups That You Should Know

The quick-service restaurant (QSR) industry is experiencing significant changes due to strategic acquisitions and expansion plans from private equity firms. This article examines the complex network of private equity influence in the QSR sector, with a specific focus on Restaurant Brands International (QSR).

Before exploring the extensive portfolio of Restaurant Brands International, it is important to revisit the origins of iconic brands like Burger King. In 2010, Burger King Holdings, Inc. was acquired by 3G Capital for approximately $4.0 billion, establishing a major player in the QSR industry, which is no surprise since QSRs are quite attractive investment opportunities for private equity firms, with their moderately consistent income streams, capacity for cash generation, and opportunities for growth.

Meanwhile, Restaurant Brands International, which possesses four of the globally recognized fast-food brands – Tim Hortons, Burger King, Popeyes, And Firehouse Subs, started on an ambitious journey in FY 2018. Their priorities included improving comparable sales for Tim Hortons, strengthening Burger King’s momentum, and accelerating the growth of Popeyes Louisiana Kitchen. While progress has been slow for Tim Hortons, the expansion of Burger King and Popeyes has emerged as significant drivers of growth.

RBI’s main focus is on expanding the Burger King brand through global franchise agreements. Notable deals have been made in the U.K., Taiwan, and the Netherlands. The growth of the Burger King chain is expected to be a major source of revenue for RBI. Popeyes Louisiana Kitchen, with a net restaurant growth of nearly 8% in Q2 and plans for expansion in Brazil, remains a crucial component of RBI’s growth strategy. The master franchise agreement in Brazil outlines the opening of 300 restaurants over the next decade.

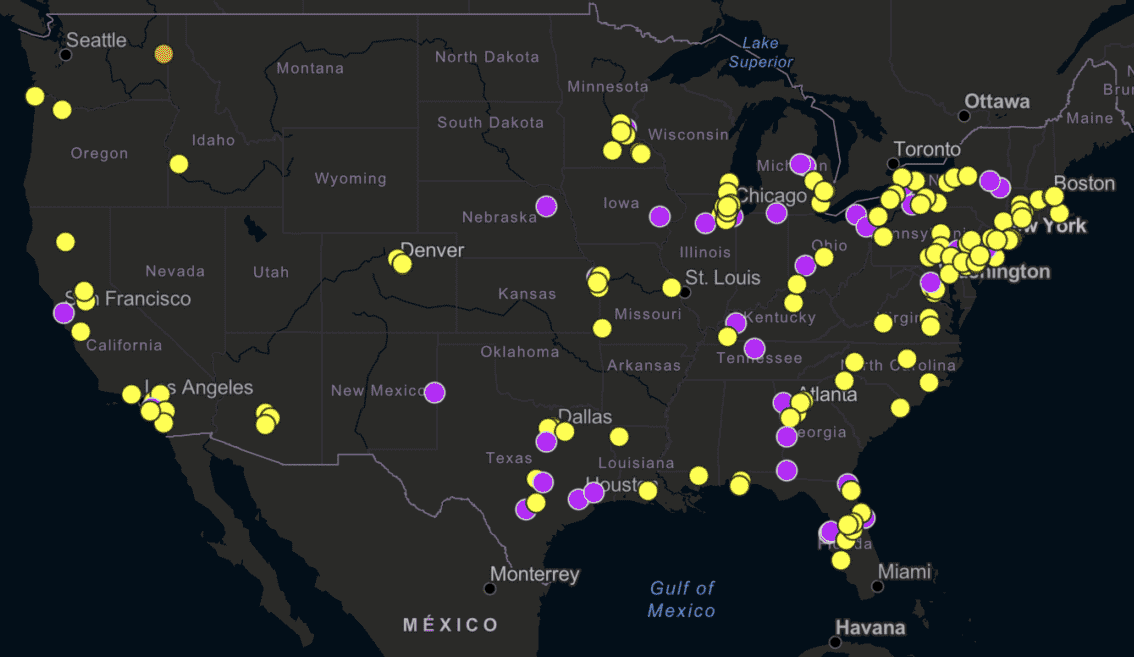

BuildCentral Is tracking 160+ RBI projects in planning and under construction. Together the projects cover over 1 million square feet of retail space. Get Started with Planned Retail.

RBI isn’t the only foray into the QSR industry. Private equity firms are increasingly acquiring quick-service restaurant (QSR) brands, with High Bluff Capital Partners recently purchasing Quiznos’ parent company. Major players like JAB Holding Co., and Roark Capital Group have consolidated various food brands under their ownership. Notable acquisitions include JAB’s purchases of Pret A Manger and multiple coffee brands, Roark’s acquisition of Rosa Mexicano and Buffalo Wild Wings, and Apollo Global Management’s takeover of Qdoba. This surge in private equity transactions within the food sector is prompting concerns about the impact on workers and the industry’s long-term stability.

The QSR landscape is currently experiencing significant changes due to strategic acquisitions and expansion efforts led by private equity firms. This article has explored the intricate influence of private equity in the QSR sector, focusing on RBI. As RBI continues to navigate its path, it prioritizes global franchise agreements to expand the reach of Burger King and drives growth through initiatives such as the master franchise agreement in Brazil for Popeyes Louisiana Kitchen. Consequently, the QSR industry remains dynamic. However, amidst these developments, the broader industry is witnessing a rise in private equity acquisitions, as demonstrated by High Bluff Capital Partners’ recent acquisition of Quiznos’ parent company.

Schedule a Free Demo

Subscribe to the BuildCentral Newsletter to receive promos, feature updates, early project insights, growth tips, and more. Published once a month, we help you stay current on industry news, sales & marketing best practices and insights into top new projects and key players.