The Mixed-Use Development Opportunity for Former Office Spaces

Table of Contents

- What is Mixed-Use Development?

- What goes into an Office Transformation?

- What Makes Conversions a Success?

- Benefits of Mixed-Use Conversions

- Top Cities Seeing Mixed-Use Developments Growth

- Types of Mixed-Use Developments

- Investing in Mixed-Use Properties

- The Future of Mixed-Use Properties

- Find Your Next Mixed-Use Project

Updated 4/16/2025.

With rising demand for urban living spaces, shifting workforce habits, and a downturn in office occupancy, mixed-use developments are top of mind for developers. According to a poll conducted on behalf of ICSC in 2019 “more than half (56%) of the adult population in the U.S. says it is very important to have daily destinations nearby.” Mixed-use developments were once centered around a balance of office, retail, and residential spaces, but these projects are now increasingly prioritizing residential components as the demand for office space is down. Investing in a mixed use development project offers diversification in investment portfolios, attracting both commercial and residential tenants willing to pay higher rents for quality facilities and optimal locations.

Table of Contents

- What is Mixed-Use Development?

- What goes into an Office Transformation?

- What Makes Conversions a Success?

- Benefits of Mixed-Use Conversions

- Top Cities Seeing Mixed-Use Developments Growth

- Types of Mixed-Use Developments

- Investing in Mixed-Use Properties

- The Future of Mixed-Use Properties

- Find Your Next Mixed-Use Project

What is Mixed-Use Development?

Mixed-use development is a forward-thinking approach to urban planning that integrates multiple uses within the same building or area. This type of development aims to create vibrant, dynamic communities by combining residential, commercial, and sometimes even industrial, cultural, and institutional uses. By blending different functions, mixed-use developments promote walkability, reduce reliance on car travel, and enhance access to amenities, making urban living more convenient and sustainable. Whether it’s a single building housing apartments above ground-floor retail or an entire district designed to offer a mix of living, working, and recreational spaces, mixed-use development fosters a sense of community and connectivity.

The Shift from Office Spaces

The COVID-19 pandemic catalyzed this shift as hybrid work became more widespread. As McKinsey notes, office attendance has stabilized at around 30% below pre-pandemic levels. This decrease has led to higher urban vacancy rates, with foot traffic near stores in metropolitan areas remaining 10-20% below pre-pandemic levels. In cities like New York and San Francisco, this change is particularly pronounced; for instance, New York City’s core lost 5% of its population between mid-2020 and mid-2022, while San Francisco’s lost 7%. McKinsey’s analysis further indicates that demand for office space could be 13% lower by 2030 than in 2019, with an even steeper decline in cities most affected by the shift to hybrid work.

To adapt, developers and city planners are increasingly looking to convert vacant office spaces into residential units and multi-use environments that support the desire for “live-work-play” communities. However, these conversions are complex and often require significant investment to meet the needs of residential tenants, such as updated plumbing, insulation, and zoning adjustments

What Goes into an Office Transformation?

Site Selection and Financing

Converting office spaces into residential areas presents a complex set of challenges and expenses. According to a report from the Center for American Progress, this process generally involves two financing stages: first for acquiring the property and second for the conversion construction itself. This approach can be financially risky because, if office rents are much higher than apartment rents, property owners may find it economically unfeasible to undertake.

Structural Conversions

The next challenge is structural; office buildings are typically designed differently from residential spaces. Many office buildings have large, deep floor plans that make it hard to provide adequate natural light in the center of the building. This is especially true of modern office buildings with large, open spaces and limited window access. Most office buildings were not designed to meet residential needs, such as individual bathrooms and kitchens for each unit, and extensive plumbing upgrades are often necessary. Office buildings often have shared bathrooms on each floor rather than bathrooms in every unit, meaning the plumbing infrastructure must be expanded for residential conversion. Additionally, most buildings lack opening windows or balconies, which are common expectations for residential units .

Zoning and Legal Regulations

Beyond structural requirements, mixed use zoning and regulatory approvals are also necessary considerations. Zoning regulations often prohibit residential use in areas designated for commercial or office purposes, necessitating a zoning variance. This approval process can be lengthy, which may deter developers from considering conversion projects.

What Makes Conversions a Success?

Market Demand

Successful conversions happen when market conditions favor high demand for multifamily housing, especially in urban areas where apartment rents can support the cost of conversion. Older Class B and C office buildings in downtown areas, which are generally less expensive to acquire, tend to be the best candidates for conversion. These buildings are usually smaller, mid-rise structures with better access to natural light, making them more adaptable to residential layouts .

Converting office buildings can be strategy to address urban housing shortages, especially when combined with government incentives to reduce the financial risk for developers.

Addressing the housing shortage through office conversions

Converting empty office spaces into residential housing is seen by many as a potential solution to address America’s housing shortage. Cities like New York, Boston, and Cleveland are actively incentivizing these conversions, while the federal government, under the Biden administration, is supporting the initiative through tax breaks and targeted programs. These efforts are timely, as office vacancies are at their highest since 1979, largely due to shifts toward remote work during the pandemic, which left many commercial buildings underused.

Benefits of Mixed-Use Conversions

Revitalizing Downtown Areas with Ground Floor Retail

The conversion of office buildings into mixed-use developments is seen as a strategic move to reinvigorate downtown areas plagued by vacancies. These mixed use districts are crucial components of modern urban planning, integrating residential, commercial, and civic spaces to enhance economic vitality, social cohesion, and community health. These buildings, empty since remote work became common, detract from the vitality of urban centers. Mixed-use spaces attract residents, increasing foot traffic that benefits local businesses, cafes, and shops, creating a more energetic community. According to Plaza Companies “By integrating different types of spaces, these projects attract a diverse range of businesses and residents, leading to increased economic activity and social interaction.”

Environmental Benefits

From an environmental perspective, converting office buildings to residential units reduces the need for new construction materials and minimizes waste. Adaptive reuse taps into sustainability principles by repurposing existing structures rather than demolishing them, which aligns with green building practices and conserves significant resources. Additionally, since these buildings are already connected to existing utilities and infrastructure, adaptive reuse limits the environmental impact associated with constructing entirely new facilities. The result is a more sustainable approach to real estate development.

Part of the attraction of mixed-use developments is their economical usage of space. In a world which is everyday more interconnected, cities are turning to innovative solutions to support growing populations, sustainable new developments, and a volatile market landscape. When people can live work and play all within their own communities, cities actually maximize their potential.

Win-Win for Everyone Involved

Mixed-use conversions allow developers to transform vacant office spaces into assets that align with current demand. Instead of dealing with underperforming office leases, property owners can convert spaces into high-demand residential units or multi-functional spaces, offering greater stability in tenant occupancy. The shift from single-use office spaces to residential or mixed-use also allows for more resilient, adaptable buildings that can evolve with market needs, supporting long-term financial viability and potentially yielding higher returns on investment.

Examples

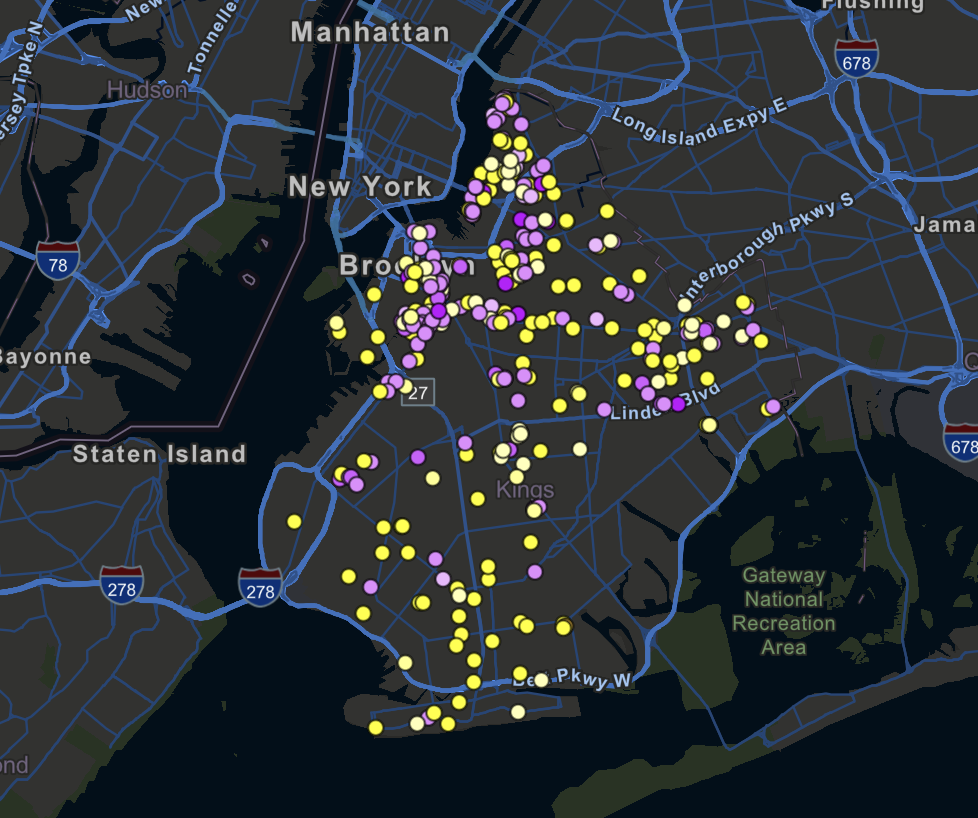

Some cities have already implemented office-to-residential conversion projects, demonstrating both feasibility and potential benefits. New York City is notable for its pilot programs offering zoning incentives and tax abatements to encourage the conversion of vacant office spaces into residential units, especially in Midtown Manhattan, where empty offices are prevalent. Recently enacted policies from both state and city levels have shown strong backing for these efforts, especially with New York State’s FY 2025 Budget introducing tax incentives which allow developers to convert offices to residential spaces if 25% of the units are offered at 80% of the Area Median Income (AMI). The tax breaks are substantial, offering up to 90% of the tax bill in Lower Manhattan and 65% in other eligible areas, with potential exemption periods of up to 35 years depending on the project timeline. A similar tax abatement, between the 1990s and early 2000s, led to the conversion of millions of square feet, for increased housing supply, including many affordable units.

Boston has made strides by easing zoning restrictions and offering retrofitting incentives to spur residential development in underutilized commercial areas, particularly in the downtown district. Massachusetts’ recently enacted Affordable Homes Act is an initiative aimed at addressing the state’s escalating housing costs and lack of affordable housing by investing over $5.16 billion into housing development and support programs. This act is projected to fund the creation, preservation, and rehabilitation of over 65,000 homes across the state within five years, significantly increasing the state’s affordable housing stock.

Top Cities Seeing Mixed-Use Developments Growth

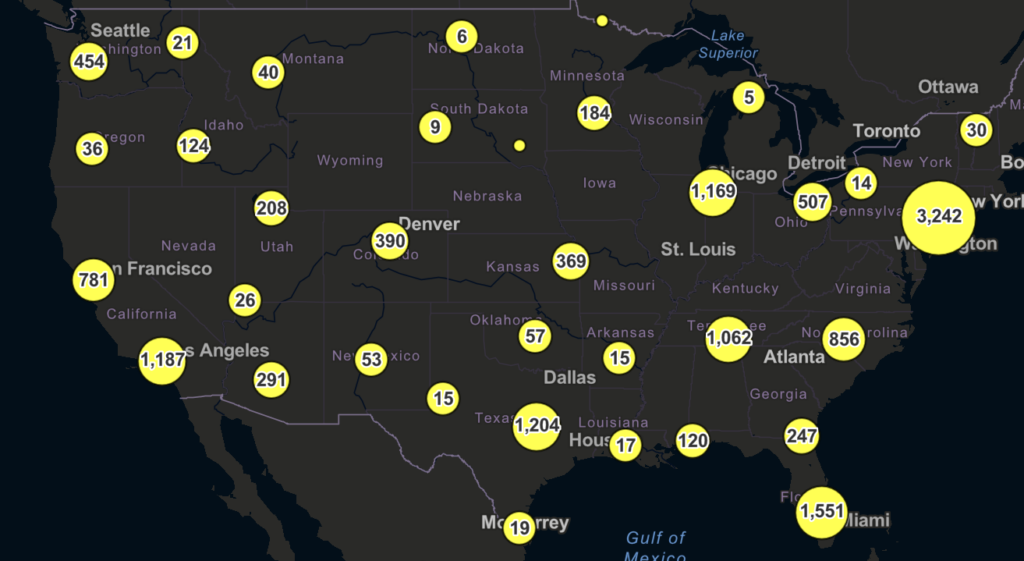

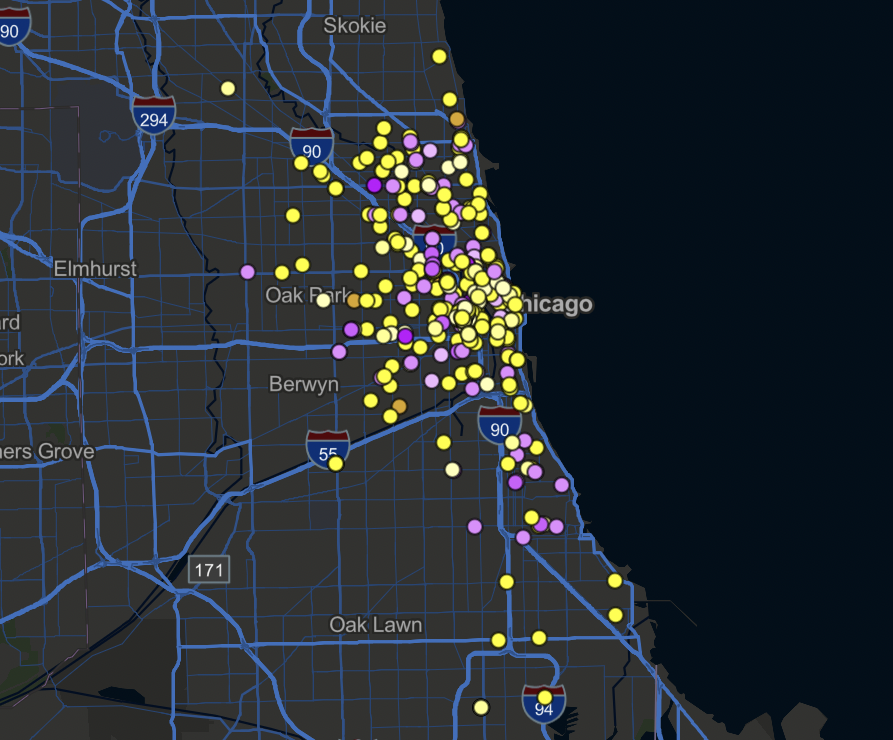

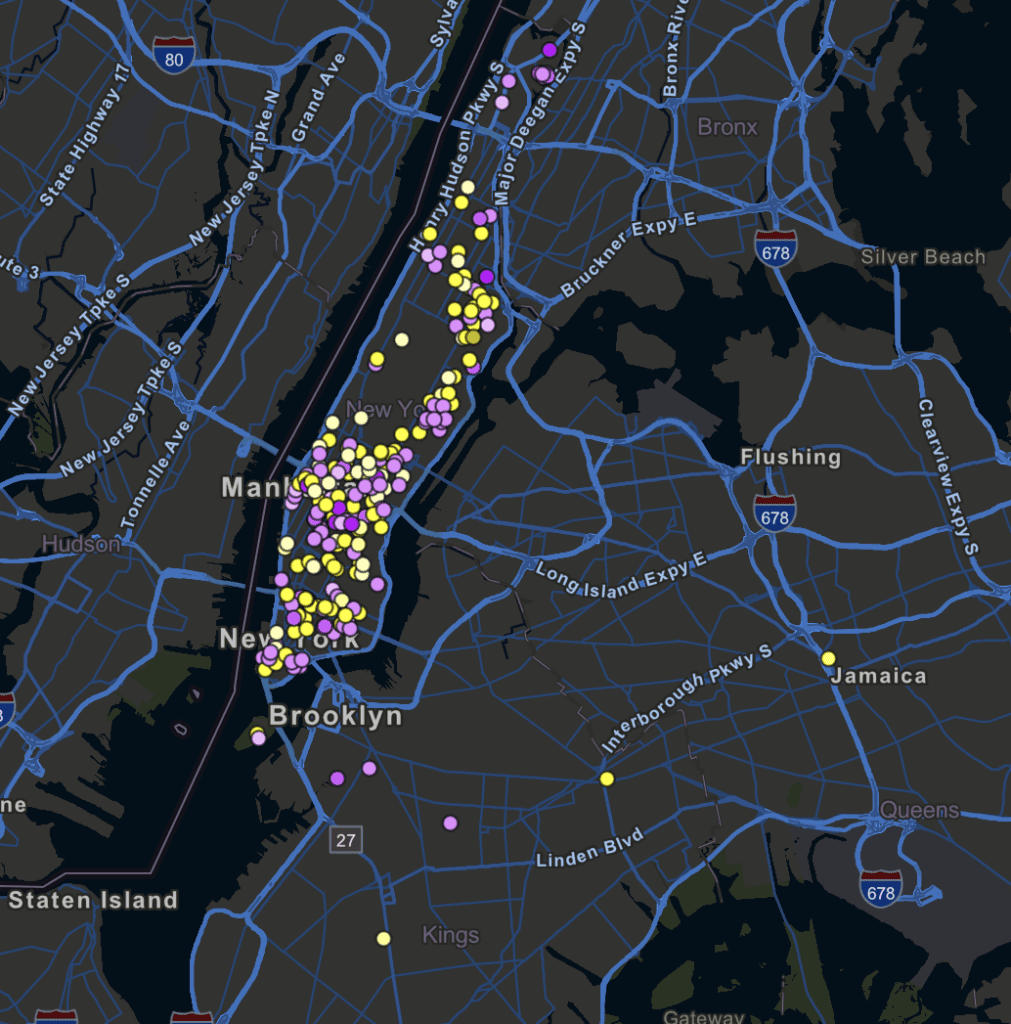

ConstructionWire is tracking over 14,000 mixed used developments. Together those projects represent more than $750B in construction value and cover over a billion square feet.

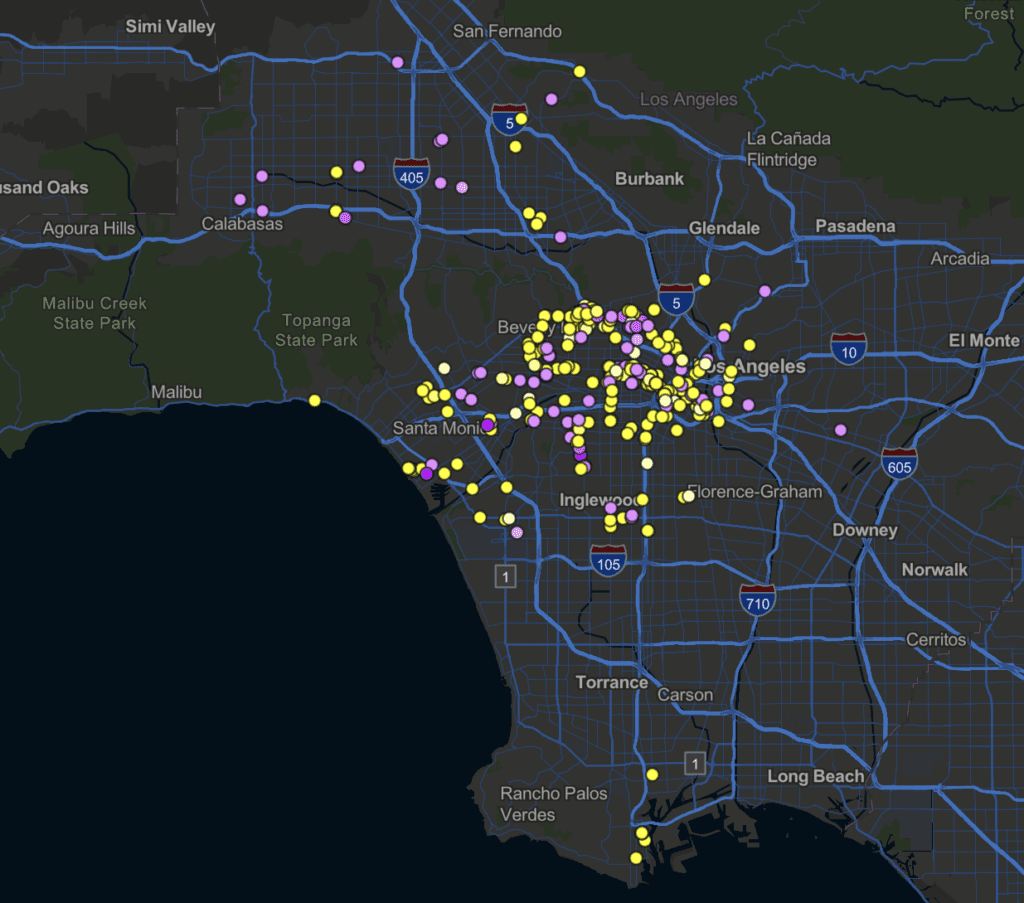

Los Angeles, CA (303)

Brooklyn, NY (299)

Chicago, Illinois (289)

Miami, FL (281)

New York, NY (202)

Mixed-use conversions of vacant office spaces have proven to be an effective response to evolving market demands and urban challenges. These projects meet a rising need for residential spaces while supporting environmental sustainability and city revitalization

Types of Mixed-Use Developments

Mixed-use developments come in various forms, each designed to meet specific urban needs and enhance community life:

Vertical Mixed-Use Developments: These projects stack different uses within the same building. A common example is residential units situated above ground-floor retail or commercial space, maximizing the utility of vertical space.

Horizontal Mixed-Use Developments: These developments spread multiple uses across a single complex or area. For instance, a mixed-use district might feature residential buildings, commercial spaces, and recreational facilities all within walking distance.

Mixed-Use Neighborhoods: These areas blend residential, commercial, and sometimes industrial uses, often incorporating a mix of old and new buildings. This approach creates diverse, vibrant communities with a rich array of amenities.

Mixed-Use Properties: Individual buildings or developments that combine multiple uses, such as a structure with residential units and ground-floor retail, offer convenience and accessibility to residents and visitors alike.

By integrating various functions, these types of mixed-use developments create lively, sustainable environments that cater to the needs of modern urban dwellers.

Investing in Mixed-Use Properties

Investing in mixed-use properties offers a range of benefits that can enhance both financial returns and community value:

Diversification: Mixed-use properties provide a diversified income stream, with rental income coming from both residential and commercial tenants. This diversification can reduce risk and increase financial stability.

Increased Property Values: By creating vibrant, dynamic communities, mixed-use developments can drive up property values. The integration of amenities and services makes these properties highly desirable.

Tax Efficiency: Mixed-use properties can be more tax-efficient than single-use properties. Investors can take advantage of tax benefits such as depreciation and interest deductions, which can improve the overall return on investment.

Environmental Benefits: Mixed-use developments promote sustainable living by reducing the need for car travel and encouraging more eco-friendly transportation options. This not only benefits the environment but also enhances the quality of life for residents.

Investing in mixed-use properties is a strategic move that aligns with current trends in urban development and offers substantial long-term benefits.

The Future of Mixed-Use Properties

The future of mixed-use properties is poised to be shaped by several key trends and factors:

Changing Demographics: As more people seek urban living, the demand for mixed-use developments is expected to rise. These developments cater to the needs of diverse populations, from young professionals to retirees.

Technological Advancements: Innovations in technology, such as data analytics and smart building technologies, are set to enhance the efficiency and sustainability of mixed-use developments. These advancements will make it easier to manage and optimize mixed-use properties.

Sustainability: With a growing focus on sustainability, mixed-use developments that incorporate green building technologies and sustainable design principles will be in high demand. These developments not only reduce environmental impact but also appeal to eco-conscious consumers.

Urbanization: The trend towards urbanization is likely to continue, driving demand for mixed-use developments that offer a range of amenities and services. These developments will play a crucial role in shaping the future of urban living.

By staying ahead of these trends, developers and investors can capitalize on the growing demand for mixed-use properties and contribute to the creation of sustainable, vibrant urban communities.

Ready to Find Your Next Mixed-Use Project?

Hubexo’s powerful analytics tools are designed to help you make informed decisions, identify prime opportunities, and streamline your path to success. Book a demo with Hubexo today to explore how we can assist in your next development.