When Cities Build New Housing Supply, Everyone Wins with Affordable, Sustainable Growth

How Does New Housing Supply Impact Rents in Growing Cities?

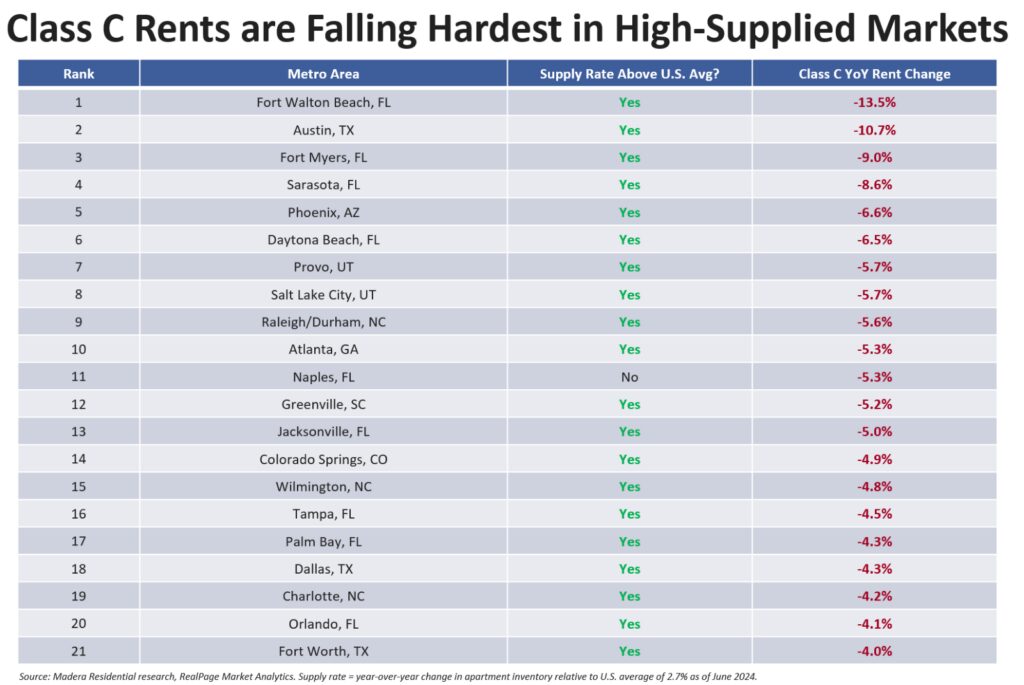

In the rapidly expanding urban landscapes of the United States, improving access to housing availability and financing options for marginalized communities is becoming increasingly crucial. For 21 cities which are building new housing, understanding the dynamics of supply and demand could be the key to controlling rental costs and fostering sustainable growth. A recent analysis of these cities highlights a compelling trend: in markets with high rates of new housing supply, rents for the lowest-priced units (Class C) are declining, even as demand remains robust. The Guardian reports this in their article.

The Relationship Between Housing Supply and Rent Growth is One of Supply and Demand

At the heart of this trend is a basic economic principle: when supply increases in response to growing demand, prices stabilize or even decrease. In the case of these 21 cities, most are experiencing above-average housing supply expansion. This growth is driven by a combination of factors, including favorable land availability, streamlined permitting processes, and significant investment in new construction.

What’s notable is that these cities don’t have a demand problem; they are generally experiencing population growth and economic expansion. Yet, despite the healthy demand, rents for Class C properties are falling by at least 4% year-over-year (YoY) in these high-supply markets. This decline is a direct result of “filtering,” a process where higher-income renters move into newly built, high-end Class A properties, prompting Class B properties to lower rents to attract Class C tenants. CNBC reports that rents are on the decline in cities that have higher supply.

The Natural Market Adjustment Behind Slowing Rent Growth: Filtering

Filtering is a natural adjustment in the housing market which benefits lower-income renters. When new, Class A luxury apartments are built, they attract renters who can afford higher rents, often vacating their mid-tier Class B units. This shift creates a ripple effect: landlords of Class B properties, now facing vacancies, reduce rents to appeal to Class C renters. Consequently, Class C properties, which cater to the lowest-income renters, may need to lower rents or at least slow down rent growth to remain competitive. Importantly, depending on local market conditions, filtering does not always occur, and unit affordability does not necessarily grow with time; the filtering observed in major U.S. cities above has begun to manifest specifically because those growing cities have committed to building new housing.

Interest rates also play a crucial role in this dynamic. Lower interest rates can lead to mortgage savings for homebuyers, making homeownership more accessible. Conversely, interest on borrowed money can be a significant cost factor for builders, especially during housing delays.

Interestingly, this trend is not uniform across all markets. In cities where new housing supply is limited, Class C rents are growing significantly—sometimes by more than 4% YoY in 22 of the 150 largest metropolitan statistical areas (MSAs). This indicates that a lack of new construction, especially in the affordable housing segment, can exacerbate rent inflation in the lower tiers of the rental market.

What Does Slowing Rent Growth Mean for New Residential Construction Activity?

While new construction tends to focus on Class A luxury apartments—largely due to the high costs of land, labor, materials, insurance, and taxes—there is a pressing need for more affordable housing. The Washington Post reports that rents have increased about 19% since 2019. Statistics regarding homes sold, median sale prices, and the competitive nature of current market conditions reveal significant insights into the housing market dynamics. In markets that are willing and able to build new apartments, this expansion can effectively slow down rent growth, even for the most affordable units.

This relationship also underscores, however, the importance of ensuring that new developments include a mix of housing options to cater to various income levels. Although housing policy discussions often lament new luxury residential construction in favor of new affordable housing, research and reporting from many significant urban markets show that even building luxury housing can slow rent growth and open up lower-rent units.

Of course, the fact that new, Class A units can indirectly offer importantly slowed rent growth should not preclude new affordable housing projects, which most directly address steep rents and a nationwide housing shortage. Regardless, let’s investigate why slower rent growth is a good thing for new residential developments.

Why Slower Rent Growth is Beneficial

Slower rent growth and especially rent reductions can have broad economic benefits which in turn promote new construction. When people spend less on housing, they have more disposable income for other goods and services, which can stimulate local economies. The number of homes sold and those selling above list price can indicate market competitiveness and affordability, reflecting the overall health of the housing market. Stimulated local economies give rise to opportunities for new businesses to thrive, consequently opening the door for new developments to spring up. Additionally, more stable or declining rents can make cities more accessible and attractive to a diverse population, supporting long-term economic growth and community vitality.

Highlighting 21 cities across the U.S. which have built multifamily units at high rates, recent research illustrates that increasing supply of housing can be an effective strategy for managing rent growth, particularly in markets which are already growing. Cities such as Austin, Texas, and Phoenix, Ariz., have seen rent growth decrease after building multifamily units at an above-average rate in recent years. By continuing to build new residential units, especially in areas with the capacity to expand, cities can create a more balanced rental market that benefits all residents.

Along the same lines, cities want not just to create momentary conditions suitable for new builds, but rather to foster a sustainable balance between new residential developments and major population growth. After all, populations will stop growing as soon as housing availability and affordability become an issue.

The Impact of Construction on Housing Markets

Construction activity is a cornerstone of the housing market, directly influencing the availability of new housing units. When construction starts increase, it signals a surge in new construction homes, which can help meet the growing demand for housing and stabilize home prices. This influx of new housing can be particularly beneficial in rapidly expanding cities, where the pressure on the housing market is intense.

Conversely, a decrease in construction activity can exacerbate housing shortages, leading to increased competition among buyers and driving up home prices. This scarcity can also impact rent growth, as fewer new units mean that existing properties face higher demand, pushing rents upward.

Moreover, the health of the construction sector is closely tied to the overall economic well-being of a community. A robust construction industry not only provides new housing but also generates jobs and stimulates local economies. As new construction projects spring up, they create opportunities for businesses and contribute to the economic foundation of communities.

In summary, construction activity plays a pivotal role in shaping housing markets, influencing everything from home prices to rent growth and economic vitality.

What Do Housing Supply and Rents Have To Do with Construction Data?

Data is the backbone of understanding housing markets, offering critical insights into supply and demand dynamics, home prices, and construction activity. By analyzing data on construction starts, housing completions, and building permits, researchers and policymakers can discern trends and patterns that shape the housing market.

For instance, data on construction starts can reveal whether new housing supply is keeping pace with demand, while information on building permits can indicate future construction activity. This data is invaluable for making informed policy decisions, such as upzoning initiatives aimed at increasing affordable housing options.

Additionally, data can pinpoint areas with high demand for luxury housing, enabling developers to strategically target their construction efforts. It also plays a crucial role in sustainability, helping identify opportunities for green building and energy-efficient construction practices.

For homebuyers, data provides a foundation for making informed decisions about their purchases. By understanding market trends and price movements, buyers can better navigate the housing market and find affordable options that meet their needs.

Furthermore, data on people moving patterns can highlight areas with high demand for housing, guiding decisions on where to build new homes. This information is essential for developing effective housing policies that address the needs of growing communities.

In essence, data is a powerful tool for understanding the complexities of housing markets, guiding construction activity, informing policy, and helping homebuyers make informed decisions. By leveraging data, stakeholders can create more sustainable, affordable, and vibrant communities.

More Apartments Being Built = Lower Average Rent

In conclusion, the experiences of 21 growing cities demonstrate that expanding supply of housing is a powerful tool for managing rent growth, particularly for lower-income residents. As new developments attract higher-income renters, the resulting market adjustments help stabilize or even reduce rents across various classes.

This “filtering” effect shows that building more housing, even if it’s primarily luxury units, can indirectly benefit those in more affordable segments. By embracing new residential projects across classes, cities can not only curb rent inflation but also create a more inclusive and economically vibrant community for all.

Want more planned construction news?

Subscribe to our quarterly, vertical-specific Market Vision reports for construction industry news, statistical analysis, construction pipelines, market leaders, project spotlights, and more.

Interested in residential developments, particularly? Subscribe to the BuildCentral residential construction newsletter.

To learn more about how you could leverage BuildCentral data, for example, to build the new housing supply that so many cities need, get started with a demo.