How Competitive Research Can Help You Win in Commercial Real Estate

Commercial real estate (CRE) is one of the most competitive industries there is. You’ve probably heard the saying “Location, Location, Location”—and as much of a cliché as it sounds, there’s a lot of truth to it. You can open the trendiest restaurant or launch a high-end retail store, but if it’s buried in an out-of-the-way corner of a strip mall or sitting in a construction zone with no foot traffic, that doesn’t help.

You’re not the only one looking for the best real estate. More often than not, competitors are scouting the same location for the exact same reason. To succeed, you need to act fast and plan smart. That’s where competitive research comes in.

In this article, we’ll explore how we can help you gain the upper hand by using insights from competitive projects and market trends. We will also discuss how to analyze competitors effectively to understand their strategies and market positioning.

Table of Contents

- Understanding Competitive Analysis

- Use Historical Data for Competitive Analysis to Understand Your Competitors’ Moves

- Use Mapping Tools and Market Research to Align Strategy with Market Demand

- Identifying Competitors and Market Position

- Track Direct and Indirect Competitors Across Multiple Industries and Construction Verticals

- Request a Competitor Analysis Report Demo with BuildCentral

Understanding Competitive Analysis

In the fast-paced world of commercial real estate, staying ahead of the competition requires more than just intuition—it demands a strategic approach grounded in data and insights. This is where competitive analysis comes into play. By systematically gathering and analyzing information about your competitors, you can uncover their strengths, weaknesses, and strategies, giving you the edge needed to thrive in a crowded market.

What is Competitive Analysis?

Competitive analysis is the process of collecting and evaluating data about your competitors to understand their market position and strategies. This involves identifying both direct competitors, who offer similar products or services to the same target audience, and indirect competitors, who cater to different audiences but with comparable offerings. By analyzing their marketing strategies, pricing, and customer engagement, you can gain valuable insights to enhance your own business strategy and secure a competitive advantage.

For instance, if you’re in the commercial real estate sector, understanding why a competitor chose a particular location or how they market their properties can inform your own decisions. This analysis helps you anticipate market trends, identify gaps in the market, and position your business to capitalize on these opportunities.

Why Conduct a Competitive Analysis?

Conducting a competitive analysis is crucial for several reasons:

Identify Areas for Improvement and Opportunities for Growth: By understanding what your competitors are doing well, you can identify areas where your business can improve and find opportunities for growth.

Develop Effective Marketing Strategies: Insights from competitive analysis can help you craft marketing strategies that resonate with your target audience and differentiate your offerings.

Stay Ahead of the Competition: Regularly monitoring your competitors allows you to stay ahead of market trends and adapt to changes swiftly.

Make Informed Decisions: Data-driven insights enable you to make strategic decisions that drive business growth and success.

Create a Unique Selling Proposition: Understanding your competitors’ strengths and weaknesses helps you develop a unique selling proposition that sets your business apart.

In essence, competitive analysis equips you with the knowledge needed to navigate the competitive landscape effectively and make informed decisions that propel your business forward.

Use Historical Data for Competitive Analysis to Understand Your Competitors’ Moves

The first step in staying ahead is knowing what your competitors have done before. Historical project data can help you spot trends in their real estate strategies and predict their next move. A comprehensive competitive analysis report should be regularly updated to reflect current market trends and include insights into competitors’ strategies and performance metrics.

For example, big-box retailers like Target love backfilling old Kmarts. Why? Because both chains need large floor spaces, cold storage, and well-located suburban sites. By analyzing the types of buildings and locations that competitors tend to choose, you can align your strategy to get ahead.

With BuildCentral’s Company Reports, you get access to:

Project activity: Track when and where your competitors have completed projects.

Decision-makers and contacts: Identify key players in real estate offices or development teams.

Use Mapping Tools and Market Research to Align Strategy with Market Demand

In commercial real estate, it’s not just about the building—it’s about what’s happening in and around the area. BuildCentral’s GEOSPEX mapping overlays give you incredibly detailed insights by combining construction project data with demographic and infrastructure details using a competitive analysis framework.

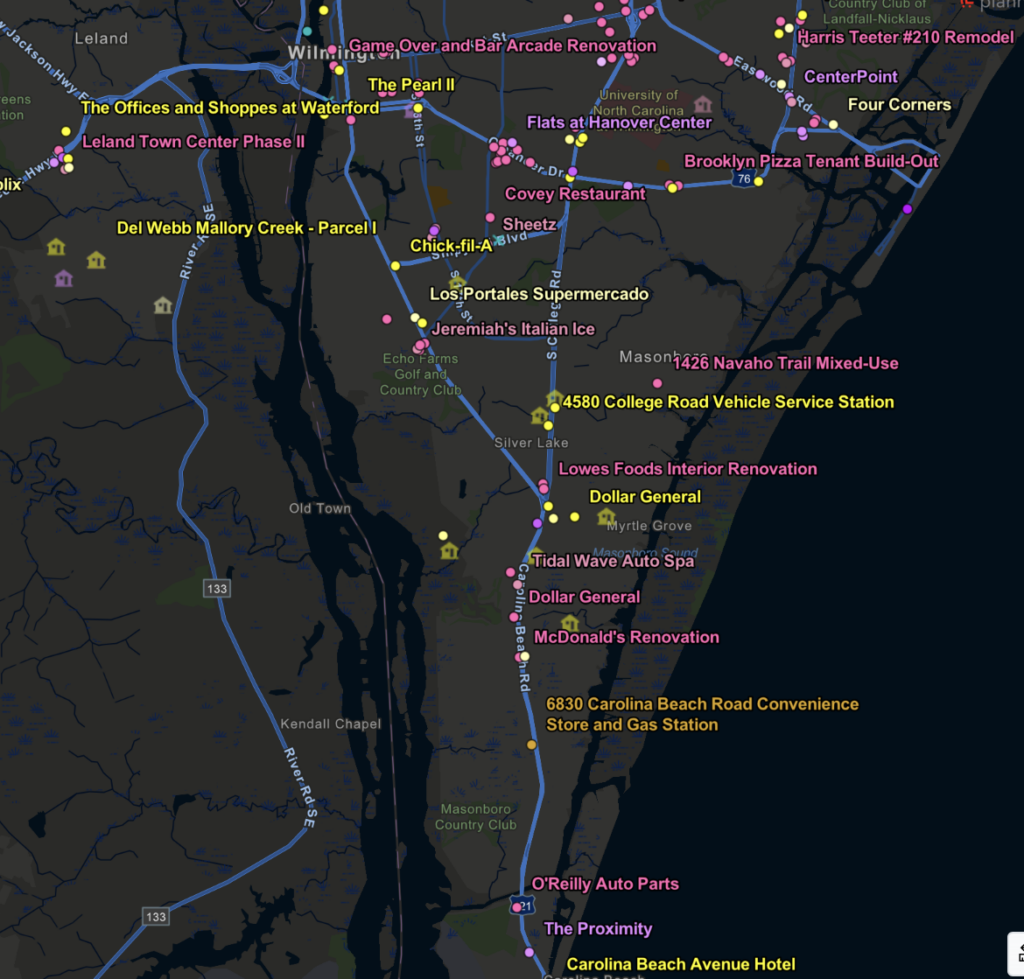

Residential Developments & Grocery Stores: If you specialize in grocery retail, knowing where new housing developments are planned can be a game-changer. Proximity to new multi-family and single-family units means foot traffic, and foot traffic means business.

Planned Retail Developments overlayed with Planned Single Family Developments

Healthcare Construction & Healthcare Deserts: Hospital closures in rural areas have created “healthcare deserts,” leaving entire communities without easy access to care. If you’re planning a new healthcare facility, overlay Census demographic data with medical construction projects to find areas in need, especially those with aging populations and limited healthcare options.

Medical Construction Projects layered with Census Data courtesy of BuildCentral

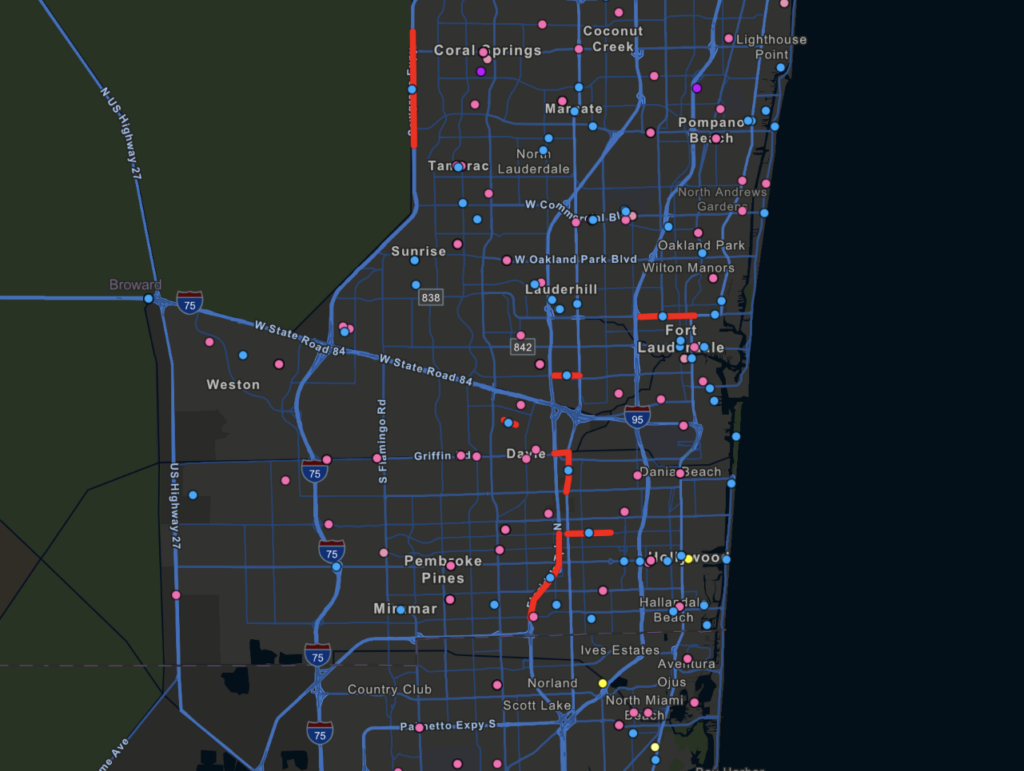

QSRs & Infrastructure Projects: Quick-service restaurants (QSRs) rely heavily on easy access and minimal disruptions. By tracking infrastructure projects, you can avoid costly surprises—like opening a new restaurant only to find the road is closed for months due to construction. Additionally, knowing where new roads or transit projects will connect communities can help you get ahead of demand.

Planned Infrastructure Projects in Southern Florida

Identifying Competitors and Market Position

A thorough competitive analysis begins with identifying and categorizing your competitors. This step is essential to understand the market landscape and develop strategies that effectively target your audience.

Identify and Categorize Competitors

To start, you need to identify who your competitors are and categorize them based on their relationship to your business:

Direct Competitors: These are businesses that offer similar products or services to the same target audience. For example, if you’re a commercial real estate developer, other developers in the same market are your direct competitors.

Indirect Competitors: These competitors offer similar products or services but to a different target audience. For instance, a residential real estate developer might be an indirect competitor to a commercial developer.

Potential Competitors: These are businesses that could enter your market in the future. Keeping an eye on potential competitors helps you anticipate market changes.

Substitute Products: These are different products or services that fulfill the same need. For example, co-working spaces might be substitutes for traditional office leases.

By categorizing your competitors, you can better understand the competitive landscape and tailor your marketing strategies to effectively reach your target audience. This approach not only helps in identifying threats but also uncovers opportunities to differentiate your business and gain a competitive advantage.

Track Who Your Competition Is Working With

Hubexo company reports allow users to view company contacts and their working relationships. That is to say, you can see who’s working with whom, as well as the project reports that bring them together.

Knowing who’s working with your competition is invaluable information. Perhaps competitor project activity puts you onto reliable subcontractors! For example, big-box retailers in a given area likely pursue many of the same contractors and service providers when completing a new backfill project. In fact, because certain facility types like grocery stores, quick-service restaurants, or even data centers require have similar needs across owners, filtering your project search for backfills is a clever way to identify brands and construction professionals who tend to work together.

Alternatively, it can help you stay away from the people involved on projects which didn’t quite pan out. A little risk mitigation never hurt anybody.

Similarly, Delivery Zones have proven to be an effective Hubexo tool for competition tracking. With the Delivery Zones mapping layer, users like grocery and QSRs and can overlay delivery areas for popular couriers like Uber Eats, GrubHub, DoorDash, and more. This way, you can literally visualize opportunity by considering your competing businesses, area demographics, and planned and upcoming projects.

Similarly, Opportunity Zones have had mixed results as an economic stimulus policy, but using the Opportunity Zones mapping layer from GEOSPEX™, users can uncover tax-incentivized opportunities in low-income communities.

In conclusion, identifying and categorizing competitors is a foundational step in competitive analysis. It provides a clear picture of the market landscape, enabling you to develop strategies that position your business for success.

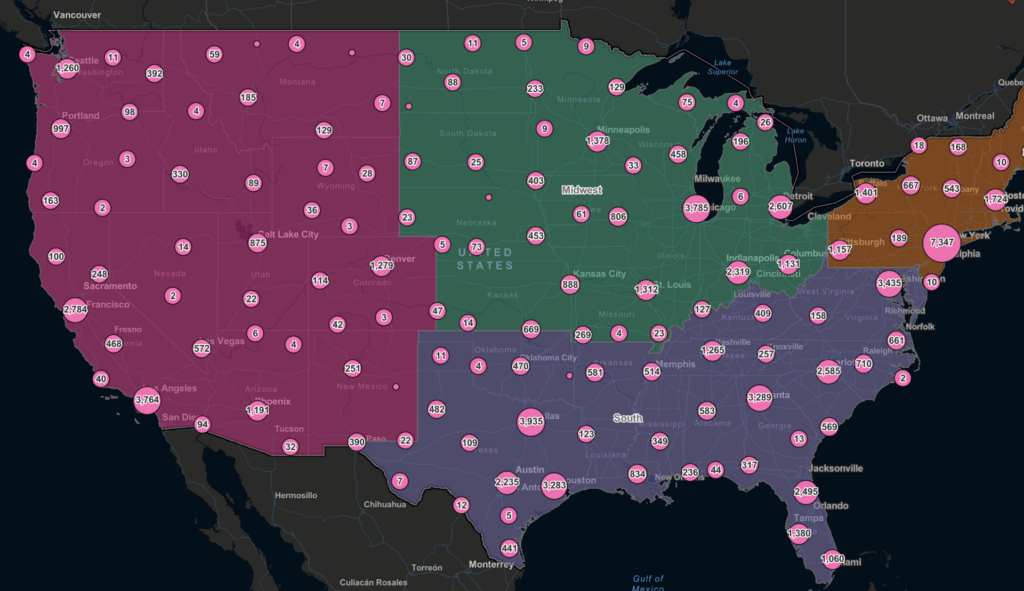

Track Direct and Indirect Competitors Across Multiple Industries and Construction Verticals

The commercial real estate landscape is interconnected, and understanding the competitors market is crucial as your competition isn’t limited to just retail or restaurants. BuildCentral’s industry insights allow you to monitor construction activity across a variety of sectors, so you can stay prepared no matter what.

Energy & Mining

Renewable energy companies like Orsted are leading a new era of energy transition, joined by clean supermajors such as Enel, Iberdrola, and NextEra Energy. Early investments in solar and wind—once considered alternative and costly—are now proving possible as these technologies take over new power installations and threaten natural gas’s foothold in the global standing.

For businesses supporting these developments, tracking these projects early offers a competitive edge. As global renewable investments are set to surpass oil and gas spending for the first time, the race to electrify the economy is accelerating, creating enormous opportunities for those who act quickly in the growth of clean energy markets. A competitive analysis example can illustrate how companies in the energy sector can strategically position themselves against rivals.

Hotels

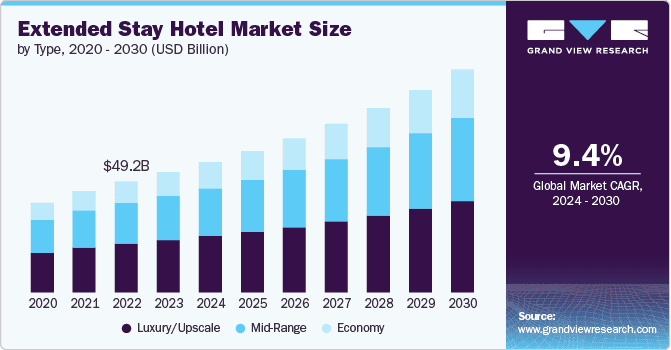

Extended-stay hotels are growing in urban areas. If you’re looking to invest in hospitality, tracking new hotel projects through competitor analysis can help you identify emerging trends and evaluate the impact on short-term rental demand. The global extended stay hotel market was valued at USD 53.24 billion in 2023 and is projected to grow at a CAGR of 9.4% from 2024 to 2030, driven by evolving consumer preferences for flexible, long-term accommodation.

Hotel giants such as Hilton, Marriott, and Hyatt have responded by expanding their portfolios with new extended-stay brands, capitalizing on the surge in demand from business travelers, relocations, and long-term vacations. Tracking these developments helps investors stay ahead of market shifts, as new brands diversify consumer options and drive competition.

Image Courtesy of Grand View Research

Infrastructure Projects

Cities are building new transit systems to connect communities with business hubs, creating strategic opportunities for retailers, QSRs, and real estate investors. Understanding the impact of these projects on direct and indirect competitors can reveal strengths and weaknesses relative to one’s own business, thereby providing valuable insights for strategic planning and market positioning. For example, U.S. Transportation Secretary Pete Buttigieg recommended nearly $4 billion in federal funding for 14 large transit projects across 11 states as part of President Biden’s FY 2025 Budget Request. These investments, supported by the Bipartisan Infrastructure Law, include expanded rail and bus rapid transit (BRT) systems designed to improve access, create jobs, and boost economic growth. Tracking these developments through programs like the Capital Investment Grants (CIG) and Expedited Project Delivery (EPD) Pilot allows businesses to identify high-value locations early, leveraging increased foot traffic and market accessibility to drive long-term success.

Medical Facilities

Rising healthcare needs, driven by an aging population, chronic diseases, and increased demand for mental health services, identified through comprehensive market research, are leading to a surge in hospitals and outpatient centers. Tracking planned healthcare developments allows businesses—like pharmacies, wellness services, or assisted living facilities—to strategically position themselves nearby and capitalize on growing demand.

Residential Growth

New housing developments not only create opportunities for businesses across industries but also drive job creation, economic growth, and entrepreneurial success. As construction projects unfold, they create direct employment for architects, engineers, and tradespeople, while indirectly boosting sectors like property management, maintenance, and security. These developments also attract businesses, stimulating local economies by providing jobs across fields such as finance, marketing, and administration. Utilizing both primary and secondary research can provide a thorough understanding of the market landscape and the impact of new housing developments.

Retail Construction

Your competitors in retail are making moves—whether building flagship stores or expanding into suburban markets. BuildCentral’s data lets you track developments pre-permit, helping you stay ahead by informing your pricing strategy based on competitors’ pricing patterns.

The concept of the Nash equilibrium seen when businesses cluster near competitors to tap into shared foot traffic, explains why moving away risks losing valuable customers. A prime example is Best Buy, which strategically opened stores near Staples and Circuit City locations, benefiting from their rivals’ marketing efforts while offering a superior experience to capture market share. With BuildCentral, you can leverage similar insights to optimize site selection and outmaneuver competitors.

Request a Demo to See How Hubexo Can Inform Your Competitive Research

Competitive research is a necessity in today’s fast-moving CRE world. Whether you’re scouting locations, planning new projects, or keeping tabs on your competition, Hubexo gives you the data and tools you need to make smarter decisions.

Ready to outsmart the competition and stay ahead of the competition? Get started with Hubexo today and see how we can help you thrive in a competitive CRE landscape. Our tools can assist you in creating a comprehensive competitive analysis report to keep you updated on market trends and competitors’ strategies.