Opportunity Zones Then and Now: Do OZs Boost Growth in Low-Income Communities?

The Opportunity Zones (OZ) initiative was established under the 2017 Tax Cuts and Jobs Act, designed to incentivize private investment in economically distressed areas across the U.S. through tax benefits. These zones provide a way for investors to defer, reduce, and even eliminate capital gains taxes if they reinvest profits into designated Qualified Opportunity Funds (QOFs) and hold these investments for a specified period.

The Internal Revenue Service plays a crucial role in certifying these Opportunity Zones and providing essential information related to tax treatment for investments in these areas.

Table of Contents

- Creation and Purpose

- How Opportunity Zones Work

- Where are Opportunity Zones located?

- Benefits for Low-Income Communities

- Challenges and Criticisms

- How do you measure the impact and efficacy of Opportunity Zones?

- Impact of Tax Incentives and Rate Cuts on Opportunity Zones

- Can We Estimate the Long-Term Potential of Qualified Opportunity Funds?

- What Does Success Look Like for Opportunity Zones?

Investors who hold their Opportunity Zone investment for at least 10 years don’t have to pay any capital gains taxes on any additional appreciation generated by a future sale of the investment. Intended to encourage economic growth, job creation, and community revitalization by channeling private capital into underserved areas, the program circumvents direct support to those areas by offering investors a tax benefit for investing in them.

Opportunity Zones target many different verticals, including multifamily, hotel, residential, and mixed-use developments, allowing for a diverse range of investment opportunities.

Creation and Purpose

The Opportunity Zones program was created as part of the 2017 Tax Cuts and Jobs Act to encourage investment in low-income communities. This initiative offers tax incentives to investors who channel their capital into Qualified Opportunity Zones (QOZs), which are designated by states as low-income census tracts. The primary purpose of Opportunity Zones is to spur economic growth and job creation in distressed communities, providing a much-needed boost to local economies and improving the quality of life for residents. By leveraging private investment, the program aims to revitalize areas that have long been overlooked, fostering sustainable economic development and community rejuvenation.

How Opportunity Zones Work

Opportunity Zones operate by providing significant tax benefits to investors who commit their capital to QOZs through a Qualified Opportunity Fund (QOF). A QOF is an investment vehicle specifically set up to invest in QOZs, and it must hold at least 90% of its assets in these zones. Investors can participate by purchasing shares in a QOF, which then allocates the funds to various projects within the designated areas. The tax benefits for investors include deferral, reduction, and potential elimination of capital gains taxes, depending on the duration of the investment. For instance, holding an investment for at least five years can result in a 10% reduction in capital gains tax, while a seven-year hold can increase this reduction to 15%. These incentives are designed to attract long-term investments that can drive substantial economic growth and development in low-income communities.

Where are Opportunity Zones located?

Opportunity Zones are located in low-income communities selected by state governors and approved by the U.S. Treasury. The designated areas typically have poverty rates of 20% or more, or median family incomes less than 80% of the regional average. These zones are spread across all 50 states, Washington D.C., and U.S. territories like Puerto Rico. Population census tracts are designated based on specific regulations and demographic data, including criteria for inclusion and the governance processes surrounding the nominations and boundaries of these tracts.

BuildCentral is tracking planned opportunity zone projects nationwide. Book a demo to see the OZs in your state.

Screenshot of Opportunity Zones in PlannedRetail projects from planning through topping out.

The program went into effect following the passage of the Tax Cuts and Jobs Act in December 2017, with the first round of Opportunity Zone designations finalized in 2018.

The efficacy of Opportunity Zones is unclear. While some areas have seen substantial real estate and infrastructure investment, the broader economic impacts, such as poverty reduction and long-term job creation, remain limited in many communities. Research suggests that by 2019, only about a quarter of the designated zones had seen notable investment. While the program has driven growth in certain regions, the true socioeconomic benefits for residents in these areas may take years to fully materialize.

Opportunity zones are chosen through a nomination process led by the Chief Executive Officers (often the governors) of each state. The Treasury Department then reviews these nominations to designate Qualified Opportunity Zones.

Benefits for Low-Income Communities

The Opportunity Zones program is designed to provide substantial benefits to low-income communities by attracting new investments. These tax incentives can help draw new businesses and create jobs, fostering economic development in areas that need it most. By encouraging the flow of private capital into these communities, the program aims to improve local infrastructure, increase access to amenities, and enhance the overall quality of life for residents. The influx of investment can lead to the development of new housing, retail spaces, and community facilities, which can have a transformative impact on the local economy and social fabric.

Challenges and Criticisms

Despite its potential benefits, the Opportunity Zones program has faced several challenges and criticisms. Critics argue that the program is overly focused on providing tax benefits to wealthy investors, rather than delivering direct benefits to the low-income communities it aims to help. There are concerns about the lack of sufficient oversight and regulation, which can lead to misuse and exploitation of the program. Additionally, some critics point out that many Opportunity Zones have seen little to no investment, questioning the program’s effectiveness in achieving its intended goals. These criticisms highlight the need for more robust monitoring and evaluation to ensure that the program truly benefits the communities it targets.

How do you measure the impact and efficacy of Opportunity Zones?

To assess the effectiveness of Opportunity Zones (OZs), we need to compare conditions in these areas before and after their designation. We can analyze the projects that were already underway before these areas became OZs and those initiated after the designation. While our project data is less complete the further back we go, we can still visualize significant growth and development in some OZs, while other areas have remained stagnant.

Continue reading to explore a map of 5 states and their Opportunity Zones before and after, featuring single-family, multifamily, and hotel developments.

Regulatory and Market Development Timelines

To assess the effectiveness of the Opportunity Zones (OZ) Act, it is essential to analyze the timelines related to its regulatory implementation and market evolution. After the program was established in December 2017, states were tasked with identifying potential Opportunity Zones, a process that was not completed until mid-2018. Subsequent regulatory guidance, which was vital for investors, was disseminated in three phases from October 2018 to December 2019. Consequently, the OZ investment framework did not become fully functional until 2020. During this timeframe, the capital accumulated by OZ funds experienced a remarkable increase, rising from $4 billion in 2018 to $48 billion by the conclusion of 2020. This escalation indicated a strong investor interest in leveraging the tax benefits offered by the OZ Act, with forecasts suggesting that total capital could have surpassed $100 billion by 2022. Notably, by 2020, nearly half of all designated Opportunity Zones had reported investment activity, reflecting a robust initial engagement from investors.

Impact of Tax Incentives and Rate Cuts on Opportunity Zones

The ongoing rate cuts by the Federal Reserve, aimed at stimulating economic growth by reducing borrowing costs, have significant implications for Opportunity Zones. Lower interest rates increase the availability of affordable capital, potentially encouraging more investors to finance projects in these designated zones. With the cost of borrowing reduced, real estate developers and businesses within Opportunity Zones may find it easier to access financing, which could accelerate development and attract more investment.

The Delay Between Investment and Economic Impact

While the influx of capital into Opportunity Zones may seem promising, a thorough examination of its economic effects requires a more detailed understanding. One crucial factor to consider is the significant time lag between when investments are made and when their economic benefits actually materialize. A large share of the funds directed toward Opportunity Zones has been funneled into real estate, especially in multifamily and mixed-use developments. Real estate attracted 68 percent of OZ investments. These projects often take a considerable amount of time to complete, involving lengthy stages of planning, permitting, and construction before they can begin to generate economic activity in the surrounding community.

A key aspect to keep in mind is the delay that exists between the initial capital investment and the visible economic benefits that follow. This delay is particularly relevant when assessing the policy’s objectives, such as reducing poverty and promoting job growth. The construction of new residential buildings can take several years, and the resulting impacts on the local economy—such as an influx of new residents, increased retail activity, and rising property values—will unfold gradually.

Mapping Opportunity Zones in Low Income Communities to Measure Development

A significant challenge in assessing Opportunity Zones (OZs) is the differentiation between the effects of the designation itself and the actual investments made. Numerous studies have concentrated on the short-term consequences of designating an area as an Opportunity Zone, often revealing minimal immediate economic changes. For instance, investigations conducted by Freedman, Khanna, and Neumark (2023) alongside Chen, Glaeser, and Wessel (2023)indicated that mere designation as an OZ did not yield observable effects on critical economic metrics, such as employment and income, in the short run. This outcome is not entirely unexpected, as designation alone does not ensure that investments will follow.

By 2019, approximately 25% of OZs had reported any investment activity. Furthermore, the economic conditions within these communities do not transform instantaneously. A plausible reason for the absence of immediate effects is that market participants may not have fully grasped the implications of OZ designation at the outset.

According to Arefeva et al. (2023), Opportunity Zones in metropolitan areas led to a 3.7% increase in employment growth from January 2018 to December 2019, and a 3.3% rise from January 2020 to December 2021. Additionally, the study found a 3% boost in establishment growth during the 2018-2019 period, with a more modest 1.3% increase from 2020 to 2021.

Can We Estimate the Long-Term Potential of Qualified Opportunity Funds?

The benefits of OZ investments are expected to materialize over an extended period, potentially spanning several years or even decades. By holding a qualifying Opportunity Zone investment through the entire investment period until December 31, 2047, investors can potentially reap the program’s most significant tax advantages.

Newly constructed properties will require time to stimulate local economic activity, and it will take even longer for such activity to manifest in broader indicators such as employment rates or reductions in poverty. Several academic studies have examined the impact of OZs on labor markets and found mixed results. One study observed a 3 to 4.5 percent increase in employment in metropolitan OZs but no effect in nonmetropolitan areas, while other research found little evidence of increased job postings or significant changes in employment rates, salaries, or poverty levels. Additionally, OZs’ impact on business investment has been less promising, with studies showing no effect on startup or commercial business investment and no statistically significant impact on new business creation or consumer spending.

The long-term effects of OZ investments will become apparent only as more projects are completed and communities start to experience the cumulative benefits of increased investment. Although preliminary evidence indicates that OZs have been effective in attracting capital, particularly in the realm of real estate development, it remains uncertain whether this influx of capital will result in significant and lasting economic improvements for the distressed communities that the policy aims to assist.

What Does Success Look Like for Opportunity Zones?

Real estate has been the preferred industry for Opportunity Zone (OZ) investments, garnering 68% of total investment dollars. This focus on real estate highlights the sector’s strong appeal due to its potential for high returns and significant tax incentives. However, other sectors lag far behind, with finance and insurance attracting only 5%, and construction 4%. The remaining 23% of investments are directed towards “other” unspecified industries.

Another reason for the delay in meaningful economic impact is that Opportunity Zones do not directly address the underlying cause of community distress, which is a lack of public investment. As the Boston Review notes, while private capital flows into real estate projects, many communities continue to suffer from inadequate infrastructure, underfunded schools, and insufficient public services. Relying solely on private investment may not be sufficient to meet public infrastructure demands. Communities would benefit from more diverse options such as grocery stores, sustainable retail developments, and public services like roads, bridges, sewage systems, and power stations.

According to the Tax Foundation, there is an opportunity to promote not just private investment but also public investment in these areas, which can create lasting community benefits. Public investments can fill critical gaps in infrastructure and services that private entities may overlook, ensuring more balanced and inclusive community development.

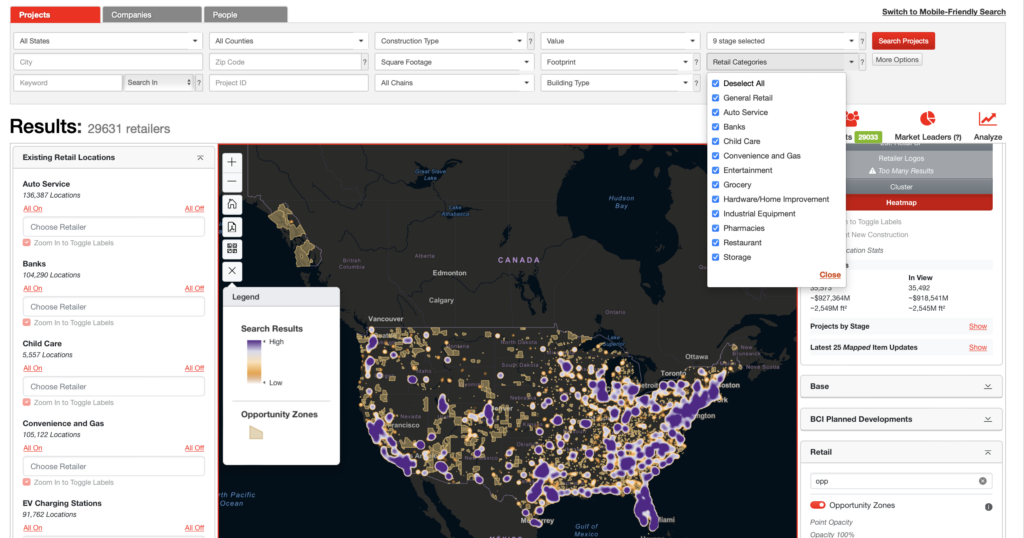

Which States are Investing in OZs?

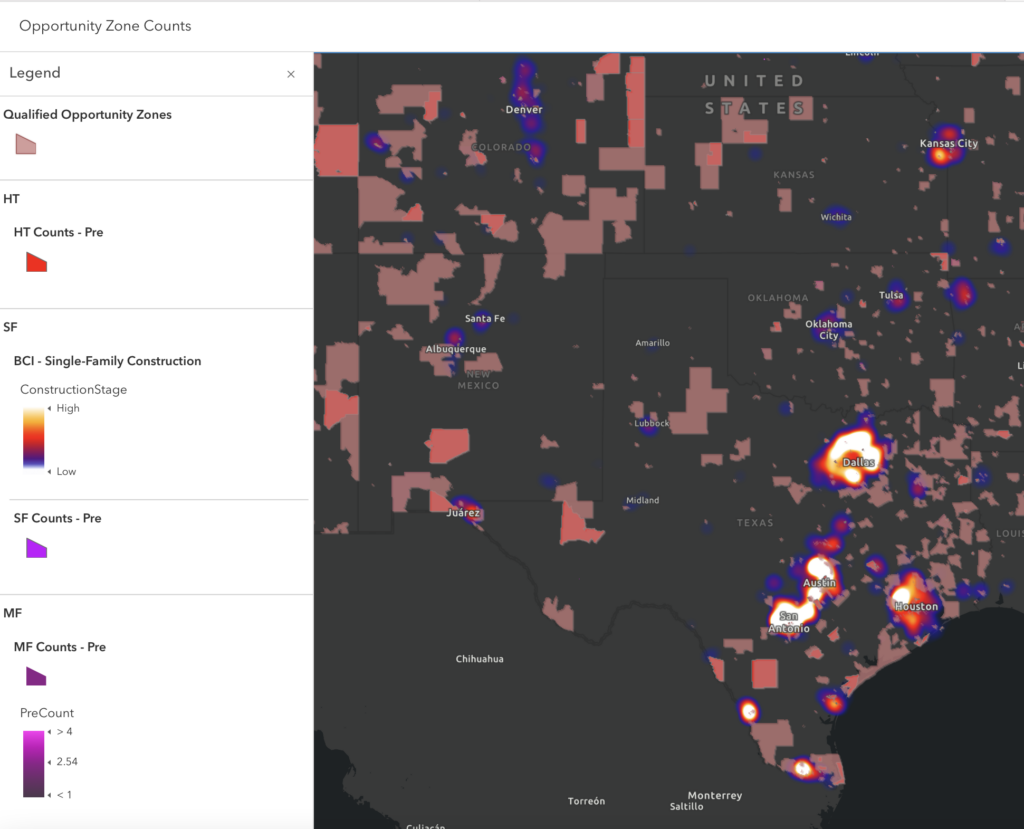

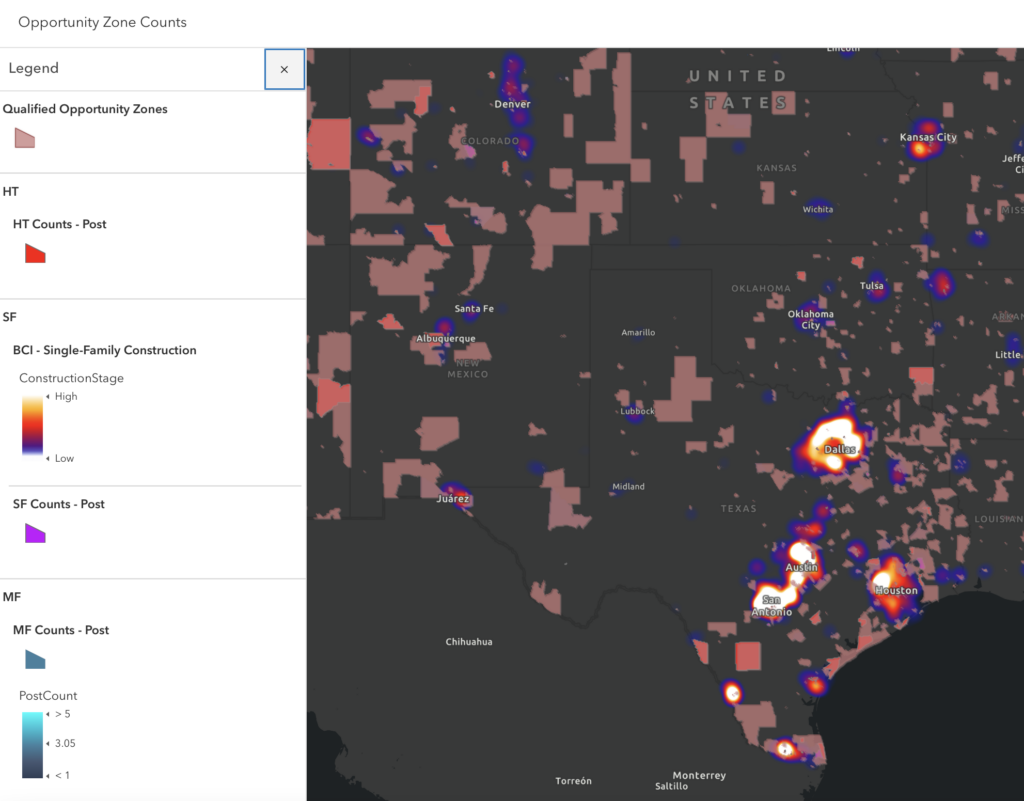

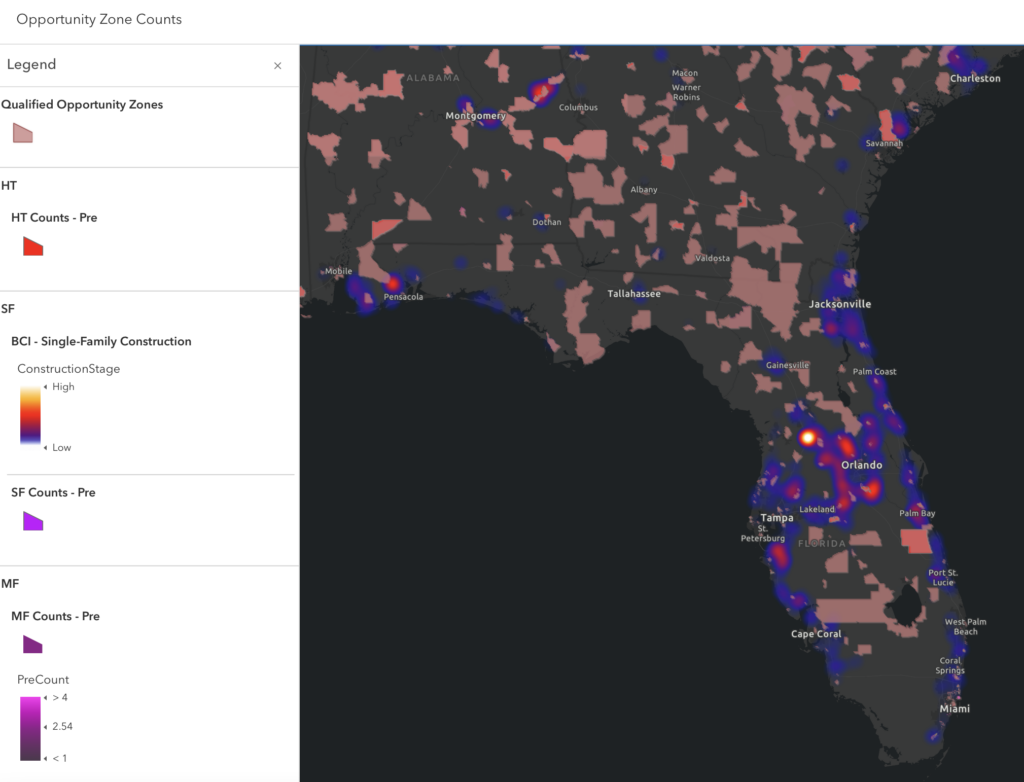

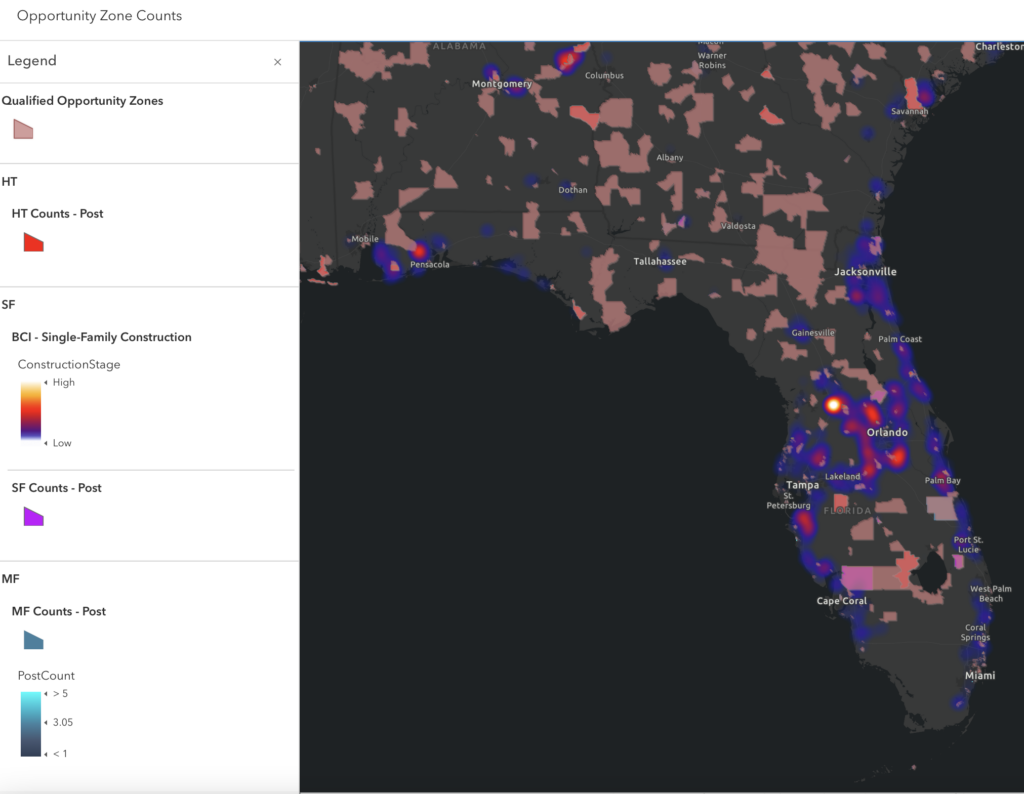

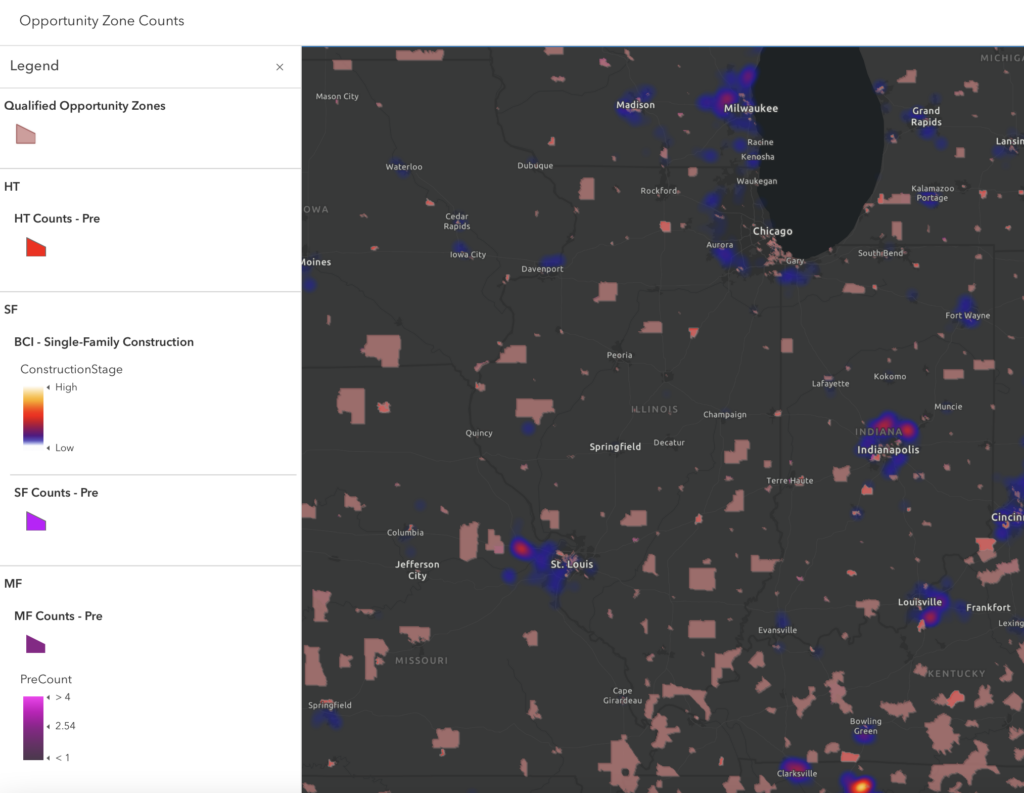

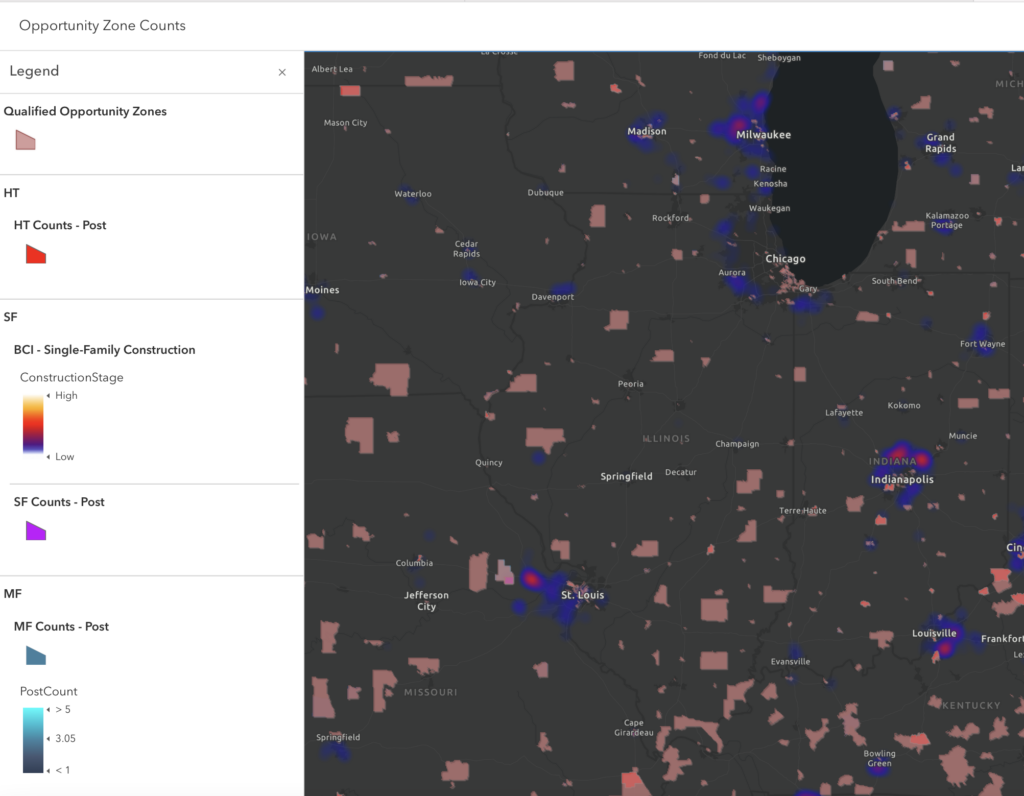

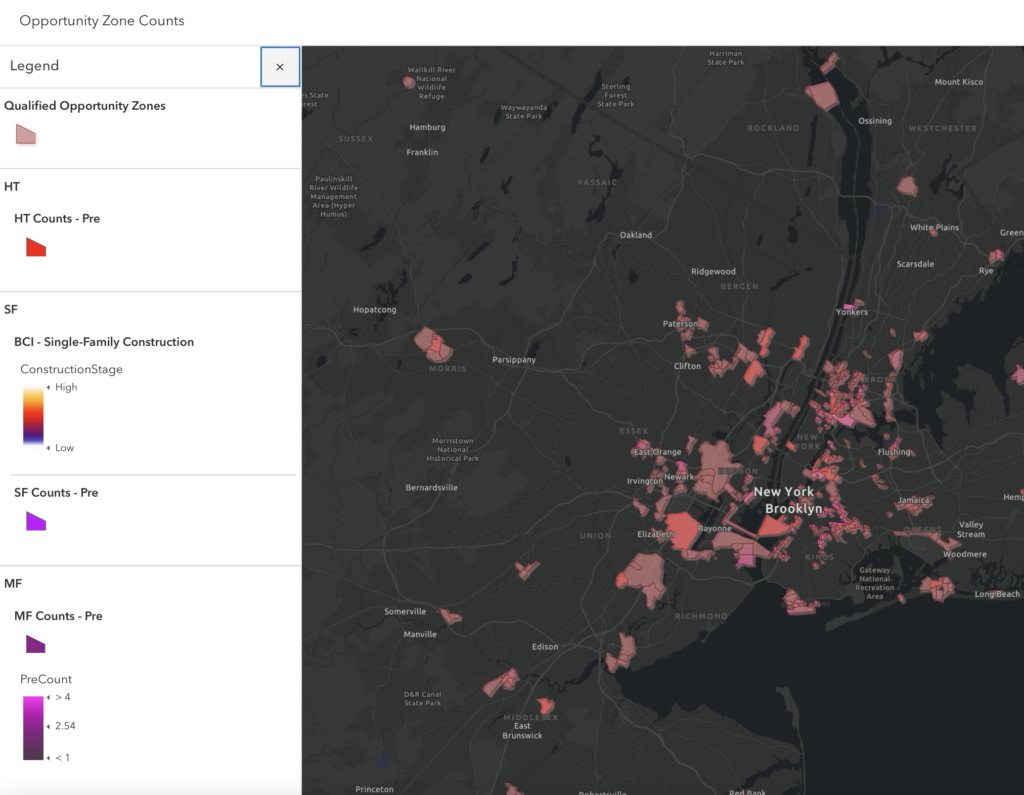

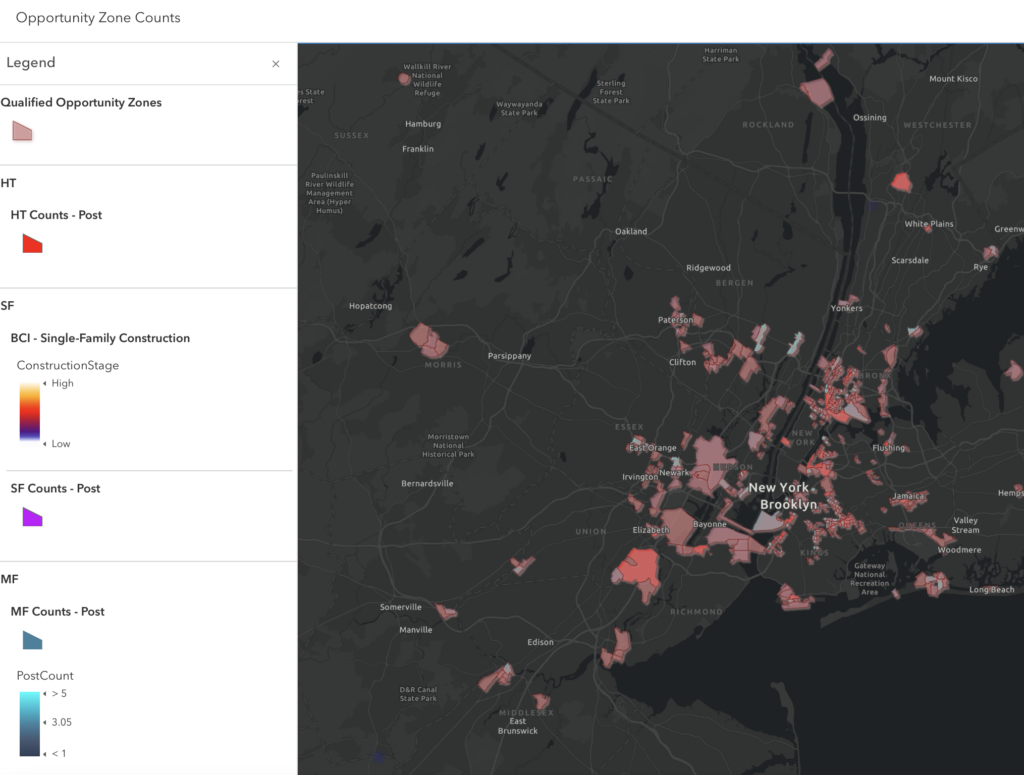

The following images show before and after images of 5 states that are investing in Opportunity Zones, data courtesy of ArcGIS powered by BuildCentral data.

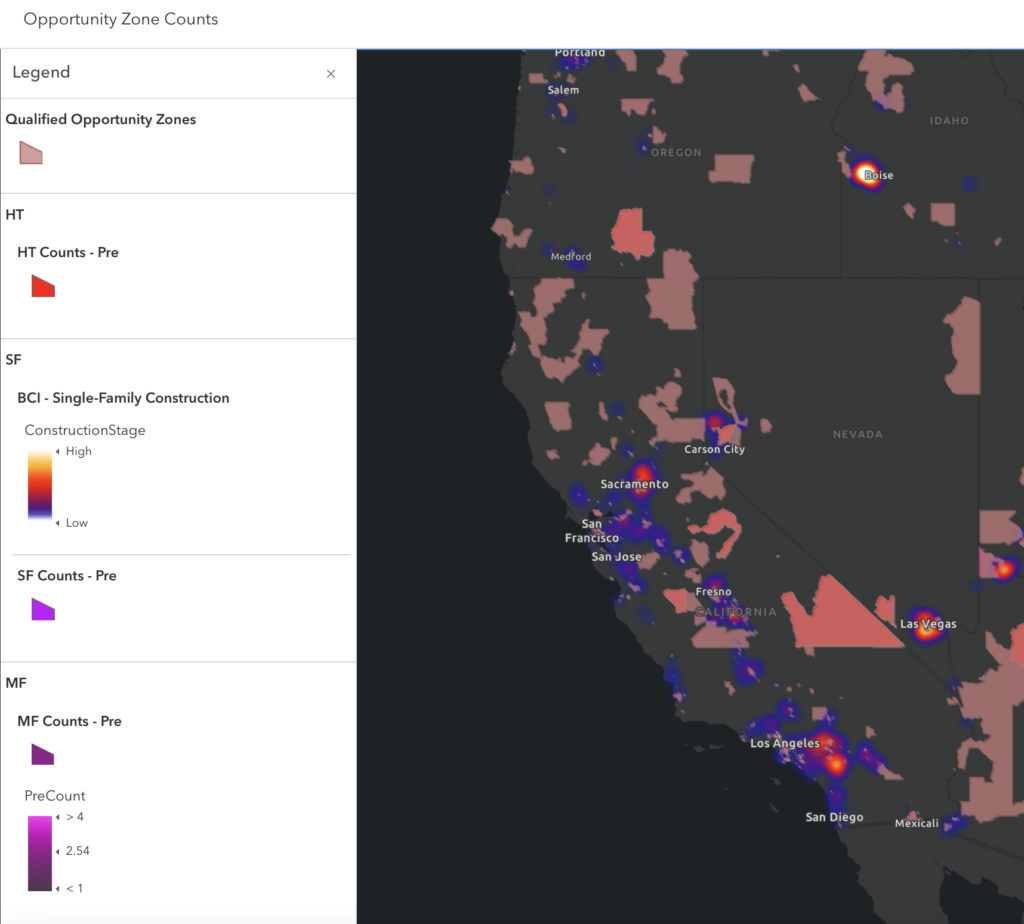

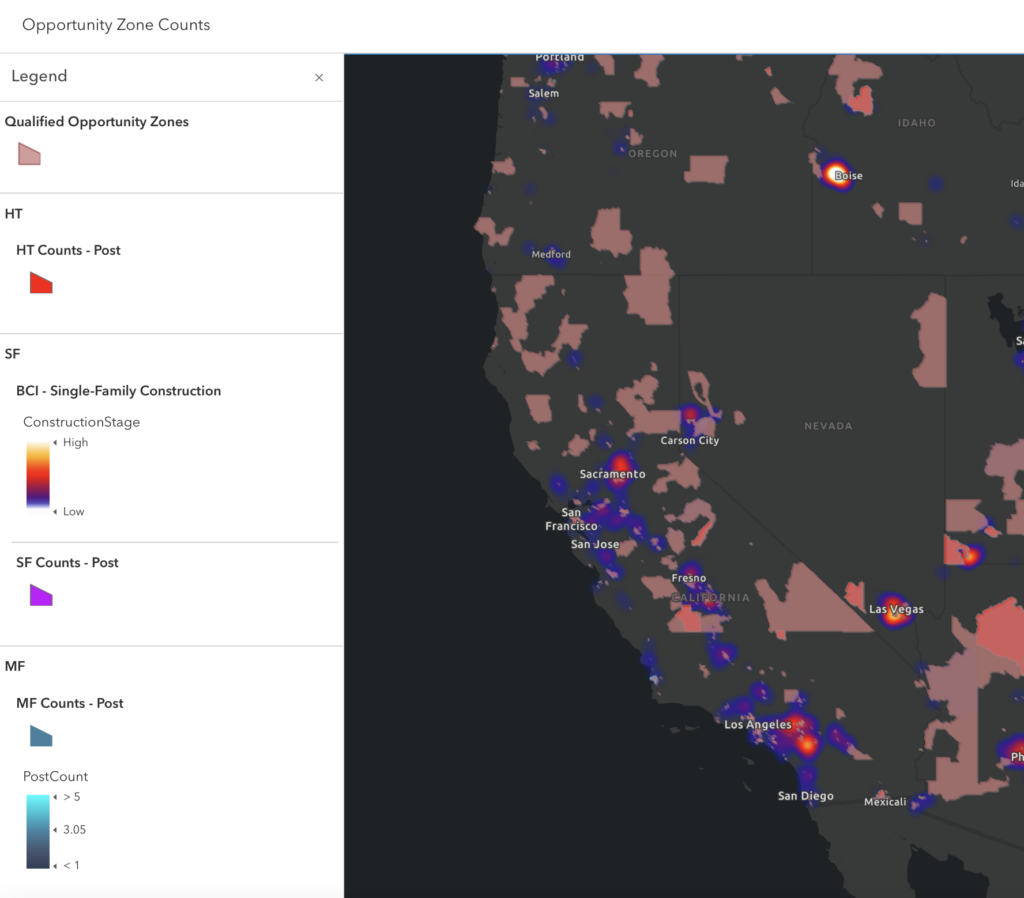

California Opportunity Zones

California has 800+ designated Opportunity Zones, nominated by the state’s governor and approved by the U.S. Department of the Treasury.

California Before Opportunity Zones

California After Opportunity Zones

Texas Opportunity Zones

Texas, the second-largest state in the U.S., has 600+ designated Opportunity Zones, making it one of the most attractive regions in the country for OZ investments.

Texas Before Opportunity Zones

Texas After Opportunity Zones

Florida Opportunity Zones

Florida has 400+ designated Qualified Opportunity Zones, which are spread across every county in the state, from the Panhandle down to the Keys.

Florida Before Opportunity Zones

Florida After Opportunity Zones

Illinois Opportunity Zones

The state of Illinois has 300+ designated Opportunity Zones.

Illinois Before Opportunity Zones

Illinois After Opportunity Zones

New York Opportunity Zones

New York has recommended 500+ census tracts for designation as Opportunity Zones to the U.S. Department of the Treasury.

New York Before Opportunity Zones

New York After Opportunity Zones

The Opportunity Zones Act has attracted substantial capital for investment in economically challenged regions. Nevertheless, the ultimate assessment of its effectiveness will hinge on the extent to which this capital results in measurable economic enhancements over time. The lag between investment and economic impact, combined with challenges in data collection and evaluation, means that it is too early to make definitive judgments about the program’s long-term success. What is clear is that OZs have created a framework for channeling private capital into areas that need it most, and with continued attention and refinement, the program holds promise for future economic revitalization.

BuildCentral is tracking planned Opportunity Zone projects in our platform. Find out how you can capitalize while revitalizing impoverished areas, book a demo with us today.