3rd Quarter Economic Growth Spurs Opportunities In the Commercial Real Estate Sector

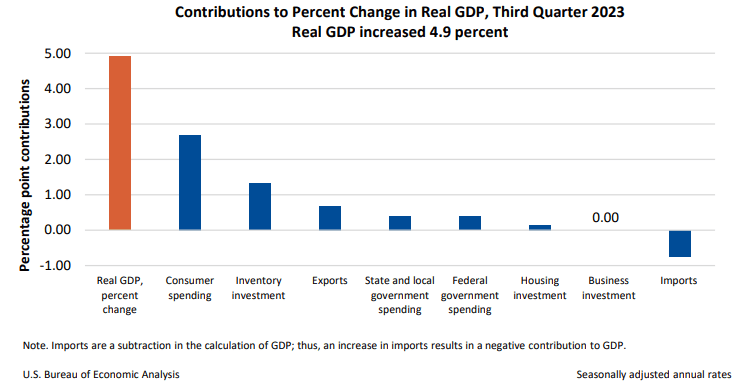

In the third quarter, the U.S. economy witnessed an impressive surge in growth, driven by a notable increase in consumer spending, increased inventories, exports, residential investments, and government expenditures, with a 4.9% annualized pace, surpassing the 4.7% estimate. This robust economic performance has profound implications for the Commercial Real Estate (CRE) sector, offering new opportunities and impacting various segments of the industry. However, what sets this economic upswing apart is the potential avoidance of a recession, which fundamentally reshapes business behavior in a less volatile environment. Though this is great news, it is not without the continuing struggles of the current CRE landscape.

What does an increase in real gdp for 3rd quarter 2023 mean for each sector of the commercial real estate industry?

RELATED:

Retail Real Estate

The retail sector is set to benefit from this favorable economic climate, driven by increased consumer spending. Established brands may seize the opportunity to expand their presence with greater confidence, while new entrants, such as quick-service restaurants (QSRs), could emerge more aggressively. The allure of mixed-use projects, which combine retail with other components, gains traction in this less volatile environment, aligning with the growing preference for convenient shopping experiences. However, it’s important to note that hard-to-get loans due to tightened lending practices, inflationary pressures affecting development costs, and fluctuating debt and interest rates may still pose challenges for new entrants and smaller businesses. These issues emphasize the need for prudent financial planning and access to capital.

This complex environment faced by retailers is further exemplified by Target CEO Brian Cornell’s recent remarks. He emphasized the trend of shoppers tightening their budgets, even on essential items like groceries, showcasing the stress consumers are feeling. As the retail giant prepares for the holiday season, Target has maintained a cautious outlook. The company had previously adjusted its full-year sales and profit expectations, despite economic forecasts and inflation data showing signs of improvement. Target’s experiences over the past years, from grappling with supply chain bottlenecks during the COVID crisis to managing inventory imbalances, are emblematic of the broader challenges facing the retail sector as it adapts to an evolving economic landscape.

Planned Retail from BuildCentral tracks planned retail construction projects from proposal through completion. CRE firms rely on its early-stage project data to make smart, responsible business decisions.

![]()

Residential Real Estate

Surging mortgage rates, higher than normal home prices, and a severe shortage of available properties have exerted immense pressure on the housing market, pushing it to levels of unaffordability not witnessed since the housing bubble’s expansion nearly 16 years ago, as observed by real estate experts and economists. The dual impact of elevated interest rates and constrained housing inventory is expected to result in the housing market’s worst performance since 2008, the year the housing bubble burst, according to projections from the National Association of Realtors.

The demand for housing, particularly within mixed-use developments, is expected to increase. Nevertheless, developers face the challenge of managing rising construction costs fueled by inflation, potentially affecting the affordability of residential units. Simultaneously, they must secure loans at favorable rates while monitoring fluctuating interest rates.

Check out Multifamily Market Vision, published quarterly.

Medical Real Estate

The healthcare industry’s prospects become more promising in an economically stable environment. Established healthcare providers may embark on ambitious expansions and ventures into mixed-use developments, driving the demand for medical office spaces. Supply chain disruptions may affect the availability of specialized medical equipment and materials, requiring careful inventory management. Additionally, securing loans for medical facility expansions and developments may be challenging due to stringent lending practices. “Commercial real estate lending has ground to a near-halt as bond yields soar.” according to Jennifer Sor from Markets Insider. Nevertheless, the avoidance of a recession provides a more secure backdrop for this segment to flourish, encouraging both established medical facilities and newer entrants to make strategic moves.

MedicalConstructionData from BuildCentral sources these planned medical construction data with its Market Leaders tool

Mixed-Use Projects

The commercial real estate industry is currently facing a challenging environment marked by high interest rates affecting property sales and development. Nevertheless, mixed-use developments, which integrate multiple property types within one building, are outperforming other asset classes. Patrick Holleran and Kent Wagster of HDA, an architecture firm in St. Louis, discussed the durability and popularity of mixed-use developments. Holleran noted that these developments are favored by investors due to their broader renter base and consistent cash flow, minimizing the impact of tenant turnover. Moreover, mixed-use projects are appealing to builders and developers because they conserve resources and promote walkability, while tenants appreciate the convenience of having various amenities within the development, making it easier to fill vacant spaces.

Mixed-use developments epitomize the CRE industry’s adaptability to less volatile economic conditions. In this more stable environment, these projects offer diversified revenue streams, attracting a broader range of stakeholders, from established brands to newcomers. As the economy continues to avoid a recession, mixed-use developments remain a promising avenue for collaboration and innovation.

What Happens to Construction in a Recession?

In the construction and commercial real estate (CRE) sectors, the avoidance of a recession brings about a stark contrast in business behavior. Recessions often lead to decreased demand for various types of real estate, with retailers closing shops, homebuilders scaling back, and medical providers delaying expansions. However, when economic downturns are averted, these industries experience rejuvenated growth and activity. The retail sector witnesses expanding businesses and increasing demand for logistics and industrial real estate, while residential builders become more ambitious and may venture into mixed-use projects. Medical facilities experience growth in demand, and the hotel segment sees more ambitious projects come to life.

Overall, the U.S. economy’s strong growth in the third quarter is a positive sign for the CRE sector, although it faces challenges such as hard-to-get loans, inflation, debt and interest rates, and supply chain disruption.

Subscribe to the BuildCentral Newsletter to receive promos, feature updates, early project insights, growth tips, and more. Published once a month, we help you stay current on industry news, sales & marketing best practices and insights into top new projects and key players.