How Inaccurate Census Data Will Impact Multi-Family Development

The 2020 census is ongoing and like many things, it has been delayed by the current pandemic.

And this may have long-standing implications for multi-family developers and their vendors.

In this Special Report we’ll dive into the following topics areas:

(Click to jump to section)

- Factors affecting Census accuracy

- COVID-19 and its effect on the Census

- Implications of undercounting of students

- Implications of undercounting of immigrants

- The future of 6 growing metros and new projects of note

Let’s begin with the the point of the census, which is to count an entire population, at the location where each person usually resides.

In addition to population numbers, the census also documents how many people stay in each home, and the sex, age, race, and income levels of those residents.

But why is the census important for multi-family markets, and how can the 2020 Census have a lasting impact for multi-family developers for years to come?

The truth is that the U.S. census contains a goldmine of demographic information for both cities and developers, and it’s imperative that such data is accurate in order for cities and developers to plan for and build multi-family housing.

What is the US Census information used for?

While there are a number of issues that could impact the 2020 census, it’s important to understand how towns and cities use census data in the first place, and more specifically, why such information is important for the multi-family housing market.

- According to the Census Bureau, federal funds and grants to communities are based on population totals, which are further broken down by sex, race, age, and other factors.

- Cities, counties, and states need funding for essential amenities such as schools, roads, hospitals, and public works.

- City planners will use census data to develop new homes and neighborhoods by interpreting information about population size, age, marital status, education attainment, homelessness, and income level, to name a few, in order to determine housing needs, patterns, and projections.

By understanding such components of a given population, planners can determine what housing is most appropriate for citizens. Importantly, the census also takes into account income level of residents, which may be especially important to developers.

The Census Bureau notes that municipalities use income levels to determine the distribution of food, health care, housing, and other assistance programs.

Developers who wish to build and market luxury-rate multi-family housing need accurate data about income to ensure that there is a demand for such high-end developments, and that residents have the ability to buy and maintain such housing.

Similarly, the census and affordable housing developers are intertwined as well.

Developers concerned about lower-income residents need to determine which regions can benefit from affordable housing and which towns and cities have the resources to offer tax credits for such projects.

What Factors Are Impacting the Census?

The pandemic has impacted the 2020 census obviously.

But there are other factors as well.

The U.S. government has taken the unusual step of cutting the census short a month early.

Further, the Census Bureau will not deliver redistricting counts to states until July 31, 2021. Pre-pandemic, those counts were to be shared by March 31, 2021.

This means that many municipalities will receive this data later than expected, which can affect how and if cities plan for, fund, and review new multi-family developments.

Ways COVID-19 Has Impacted the 2020 Census

The COVID-19 crisis in particular has brought significant challenges to the Census Bureau’s attempt to obtain accurate data.

While door-to-door interviewing is usually a reliable method for gathering information, this year, the U.S. Government Accountability Office anticipates that people will be less responsive to survey takers, and understandably so.

With fears of spreading or catching coronavirus, especially in states experiencing large outbreaks, it makes sense that people would be less likely to open their door to strangers in order to complete the census.

Undercounting Domestic and International Students

College students, in particular, are one population whose information may be delayed or inaccurate.

As universities around the country grapple with fully reopening, going remote, or offering a hybrid of the two, college students are struggling with decisions about when and if they will return to campus.

The Census Bureau takes into consideration college students who live on campus in dorms as well as in off campus housing.

Essentially this means that students who normally spend most of the year in a college town may not be considered residents of that location by the Census Bureau’s standards, and may instead be reported as part of their parents’ household numbers.

This is also true for international students as well. Regardless of home c0untry, they are normally counted as residents of the college towns in which they attend school.

But if these students have left the United States, they may no longer be considered in the census.

This may result in college towns underreporting their populations, and 2020 census problems could impact the amount of student housing cities and universities anticipate needing in the future.

More specifically, this could affect university budgets and master plans significantly.

Undercounting Transient Families Affected by the Pandemic

And college students aren’t the only ones moving back in with family.

Some people with the ability to work from home have temporarily relocated to relatives’ houses in regions that have fewer outbreaks, oftentimes moving out of town or even out of state.

Those with young children may also move back in with parents as childcare becomes scarcer or even nonexistent.

Undercounting Immigrants

In addition to the COVID-19 outbreak, some communities leery of the government may be more hesitant to complete the census.

Recently, President Trump issued a memo calling to exclude undocumented immigrants from the official numbers used to allocate seats in Congress.

But even before this memo was released, many were uneasy about completing the census due to concerns about the government using such information to target undocumented immigrants, although federal laws forbid this.

According to the Urban Institute, nearly a third of adults are “extremely or very concerned” about how their answers to the census will be used, and 40% of adults in immigrant families think it’s “extremely or very likely” that such information will be used to target undocumented persons.

And although the Supreme Court did block a proposed citizenship question in 2019, uncertainty about surveillance and fears of arrests or deportations may keep immigrants from completing the census.

Such underreporting could have lasting consequences for municipalities trying to track density and population growth, especially in states that have higher numbers of undocumented immigrants.

An estimated 2.2 million undocumented immigrants reside in California, and another 1.6 million live in Texas.

Florida has an estimated 775,000.

If a great number of such a large part of the population opt out of the census, it could affect cities’ ability to predict housing patterns and future growth.

6 Top Metros To Watch

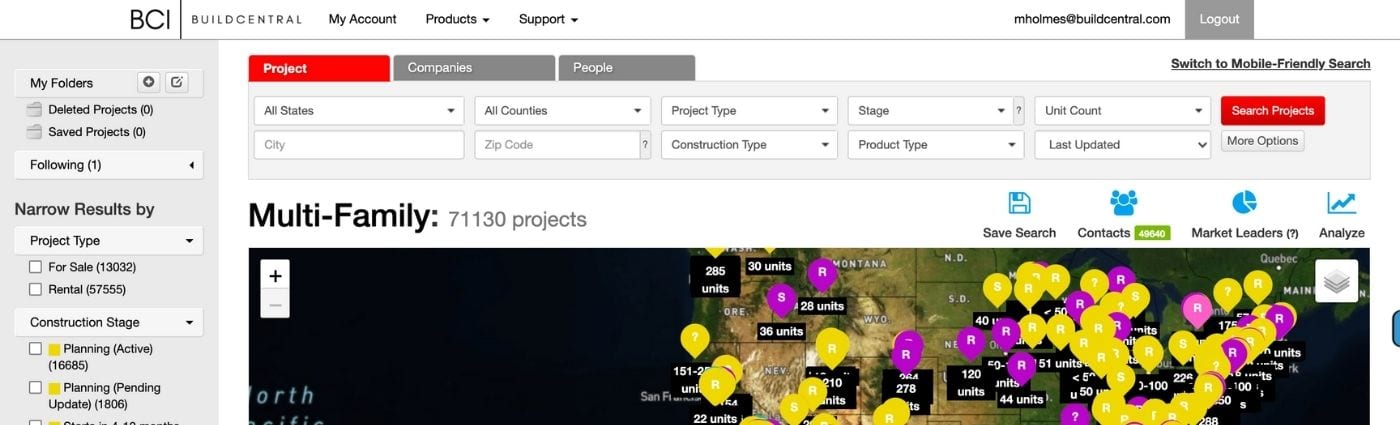

Over the past decade, we have added and tracked over 70,000 new multi-family projects.

In that research we came across 6 metros worth examining further as we look towards the future.

DALLAS

The Dallas-Fort Worth metroplex has seen an increase of about 1 million people, with a 1.8% increase between 2017 and 2018 alone. And a report by Cushman & Wakefield predicts a population growth of 17.9% over the next 10 years.

Here’s a notable project in the area that we’re tracking:

| Title Address/Location City/State/ZIP |

Constr. Type | Proj.Type Build.Type | # of Units | Stage (?) Start/ End |

Product Type | Value ($M) |

|---|---|---|---|---|---|---|

| Mockingbird Station East

Dallas, TX 75206 |

New | Rental High-rise |

> 350 | Planning (Active) | Market Rate | > $100 |

AUSTIN

Austin, Texas, was fifth in the nation in terms of population growth over the past decade, with an increase of 177,079 people between April 1, 2010 and July 1, 2019.

Driven in part by factors such as the city’s recent tech boom and relative affordability, experts expect Austin to gain another 600,000 residents in the next decade.

Here’s a notable project in the area that we’re tracking:

| Title Address/Location City/State/ZIP |

Constr. Type | Proj.Type Build.Type | # of Units | Stage (?) Start/ End |

Product Type | Value ($M) |

|---|---|---|---|---|---|---|

| Westminster Carlisle Tower

4100 Jackson Avenue

Austin, TX 78731 |

Addition/Expansion | Rental Mid-rise |

133 | Early Construction 6/2020 – Q3/2022 |

Senior | $115 |

DENVER

Denver is another city that has experienced significant growth, with an added 127,000 people – or 21% – since 2010.

Here’s a notable project in the area that we’re tracking:

| Title Address/Location City/State/ZIP |

Constr. Type | Proj.Type Build.Type | # of Units | Stage (?) Start/ End |

Product Type | Value ($M) |

|---|---|---|---|---|---|---|

| Vertical Medical City-Denver

Denver, CO 80022 |

New | Rental | 151-250 | Planning (Active) | Senior | > $100 |

LAS VEGAS

Las Vegas, a city historically known for gambling and good times, has become much more family-friendly over the past decade, with a population increase of 13.40% since 2010.

Here’s a notable project in the area that we’re tracking:

| Title Address/Location City/State/ZIP |

Constr. Type | Proj.Type Build.Type | # of Units | Stage (?) Start/ End |

Product Type | Value ($M) |

|---|---|---|---|---|---|---|

| Kaktus Life III

8030 West Maule Avenue

Las Vegas, NV 89113 |

New | Rental Mid-rise |

> 350 | Starts in 1-3 months Q4/2020 – Q4/2022 |

Market Rate | $25-$100 |

SEATTLE

Seattle, another tech hub, saw an increase of 22% since 2010, and with it, seemingly infinite multi-family developments.

Here’s a notable project in the area that we’re tracking:

MIAMI

And Miami isn’t just a tourist destination anymore: it’s grown about 17.5% since 2010.

Here’s a notable project in the area with two phases that we’re tracking:

| Title Address/Location City/State/ZIP |

Constr. Type | Proj.Type Build.Type | # of Units | Stage (?) Start/ End |

Product Type | Value ($M) |

|---|---|---|---|---|---|---|

| Kenect Miami Phase I

1016 NE 2nd Ave

Miami, FL 33132 |

New | Rental High-rise |

450 | Starts in 4-12 months Q1/2021 – Q1/2023 |

Market Rate | $25-$100 |

| Kenect Miami Phase II

1016 NE 2nd Ave

Miami, FL 33132 |

New | Rental Skyscraper |

468 | Planning (Active) | Market Rate | > $100 |

These are just a handful of cities that have seen incredible growth since the 2010 census and inaccurate data may impact funding, demand, and planning for the next 10 years.

Summary

To be sure, reliable, accurate census data is crucial for healthy multi-family markets. From the fastest-growing cities in America to even the tiniest townships, city officials need to correctly gauge population growth and decline in order to make sound decisions about zoning, density, and planning for multi-family developments.

- Municipalities need correct population info to determine how schools, hospitals, roads, and other public works get funded.

- For parents who typically take school district quality into consideration when choosing a home, a lack of school funding could potentially deter families from certain communities, thus lowering the demand for multi-family housing.

- Elderly residents who are concerned about the quality and accessibility of hospitals and clinics may decide against moving to a city with poorly-funded healthcare facilities, meaning the apparent need for senior housing in a given location may decline.

- Developers who study and rely on census data may have a difficult time making profitable decisions about where to build multi-family developments, how many units to offer, and who to market such housing to. Information about population size, income and wealth, and age is crucial for gauging demand.

Even if the 2020 census is exceptionally accurate, the delays and extended deadlines may make it difficult for developers to plan larger, long-term projects.

How BuildCentral Can Help Developers

The good news for developers is that while government data may not always be completely accurate or timely, BuildCentral tracks multi-family projects of all values across the United States, often receiving updates directly from architects, general contractors, and engineers.

This means that developers and other interested parties can learn about projects early on in the funding, design, and planning phases.

Specifically, our MultiFamilyData product allows clients to sort and filter projects for best results, including by location, value, type (ie, luxury, senior, affordable), and stage of development.

Developers can see which cities are greenlighting certain types of multi-family housing, how demand changes by region and community, and which kinds of multi-family housing are securing funding.

In a moment when there are concerns about the 2020 census’ precision, BuildCentral offers an an alternative method for getting a read on growing markets.